Main takeaways:

The good:

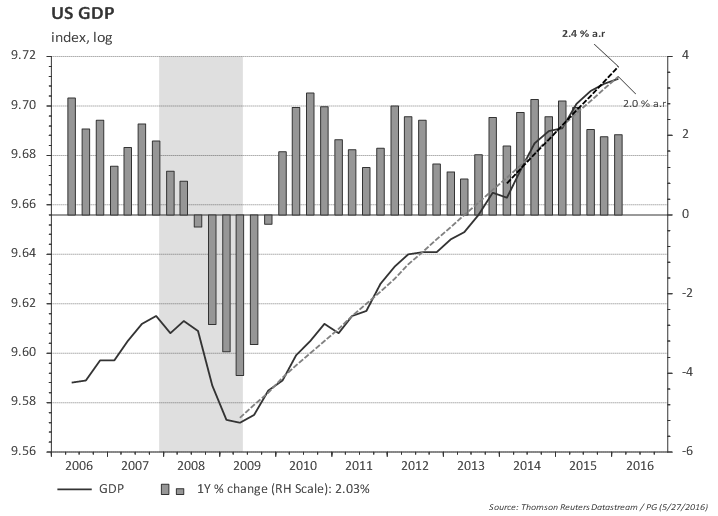

- Overall 2% yoy growth is good given the headwinds the energy sector, strong dollar and tighter financial conditions in 2015.

- 1Q GDP revised up three tenths to 0.8%.

- First released of real GDI at a strong 2.2% and 4Q15 was revised up by 1 percentage point to 1.9%.

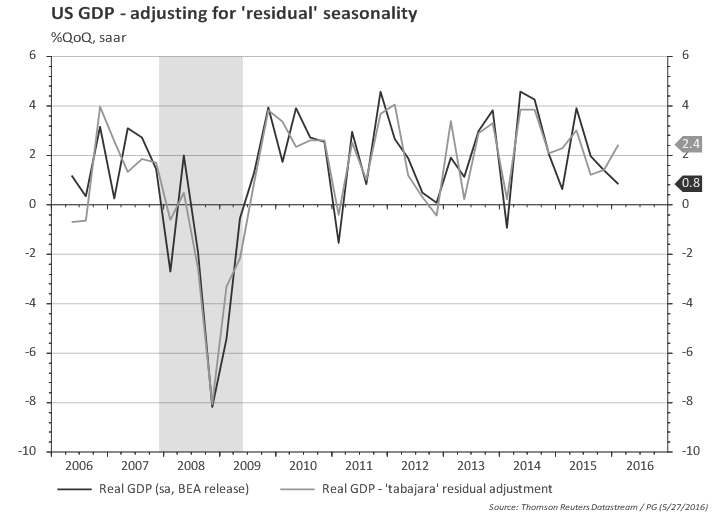

- Adjusting for 'residual' seasonality would lead to a materially higher growth in 1Q (2.4%), more in line with the income report (GDI).

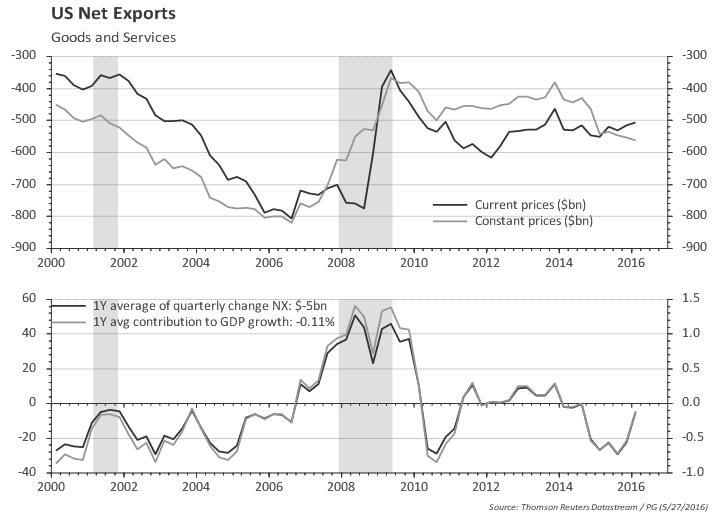

- Net exports appear to be improving, after subtracting more than 0.5 percentage points from 2015 growth.

- Residential investment is performing quite well.

The bad:

- Growth in 2Q15 was 3.9% so there is a high hurdle for keeping annual GDP at 2%.

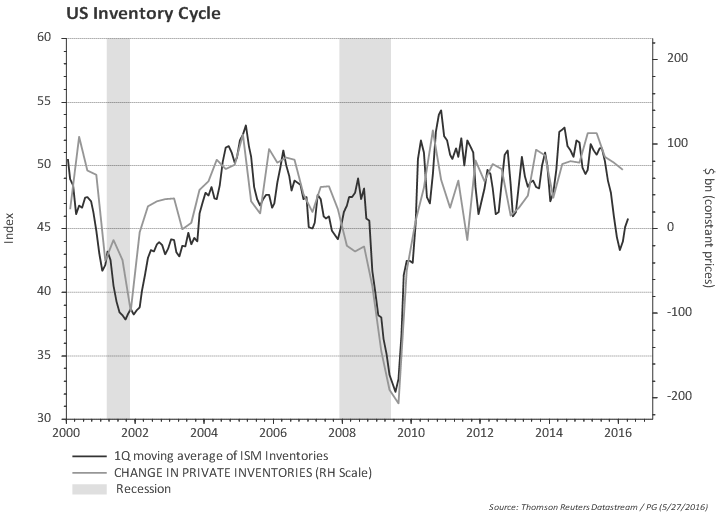

- ISM suggest the inventory cycle is not complete. Change in inventories will likely to continue subtracting from growth.

- Household consumption slowed down materially (but there's some hope it will rebound, based on the latest retail sales report).

- Non-energy related investment slowed down substantially in the last two quarters. Is the energy crisis spreading to other sectors ? Most recent durable goods report does not show any substantial improvement in capex.

- Discretionary spending slowed down in the last few quarters, and this often is a bad omen for future growth.

Outline of the rest of the report:

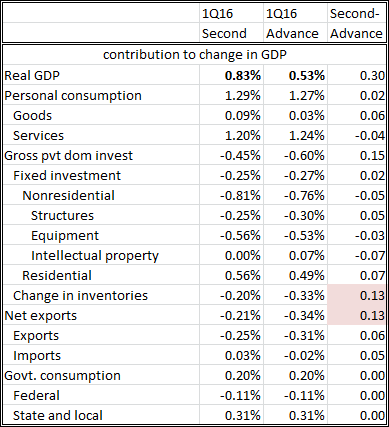

- GDP second release vs. advance

- GDP vs. GDI

- GDP Plus

- Discretionary spending

- 'Residual' seasonality

- Inventory cycle

- Chart pack -- full details

GDP second release

First quarter GDP revised up three tenths to 0.8%; first release of real GDI at a strong 2.2% and real GDI for the 4Q15 was revised up by 1 percentage point to 1.9%.

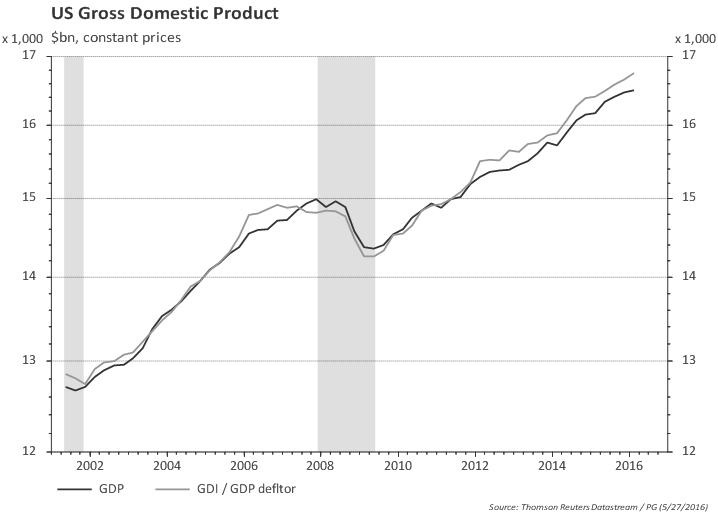

GDP and GDI

Both measures -- Gross Domestic Product and Gross Domestic Income -- should be equal (income = expenditure) but the data sources used to produce them are different and there is no effort to reconcile them, thus both contain valuable information. GDP uses the final expenditure approach and GDI is measured using the income approach. GDI is not available at the time of GDP's advance release and often gets relegated to a secondary role, although some researchers point to GDI as a better gauge of the economy (e.g., Nalewaik, J.J. (2010), “The Income- and Expenditure-Side Estimates of U.S. Output Growth," Brookings Papers on Economic Activity, 1, 71–127).

The chart below plots both GDP and GDI. Interesting to note that GDI was flat ahead of the last recession while GDP was still trending up -- so, in that case, GDI provided a better heads-up for the incoming recession.

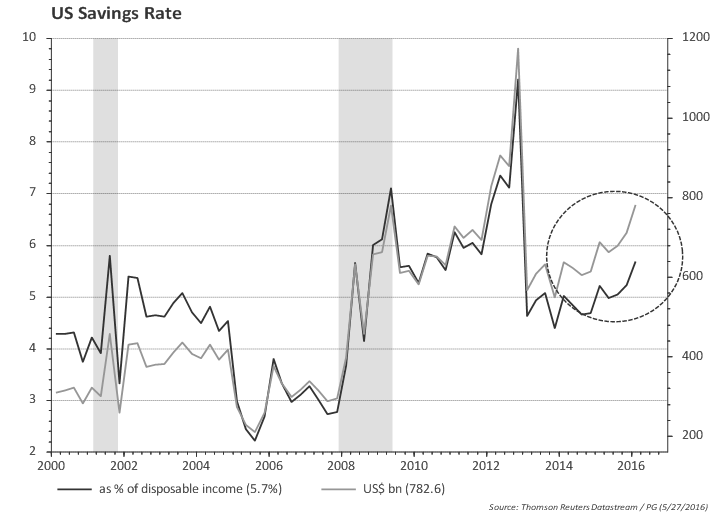

Another way of looking at the discrepancy between income and expenditure is to look at household savings rate. Consumers held off buying despite healthy income gains.

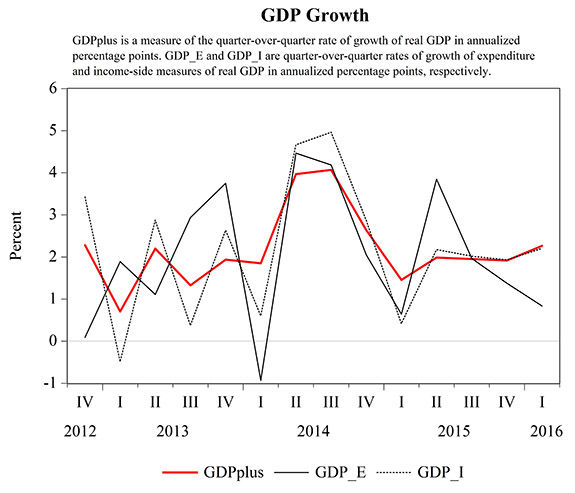

GDP Plus

An estimate of growth using both GDP and GDI is produced by

Aruoba, Diebold, Nalewaik, Schorfheide, and Song (ADNSS) and is called

GDP Plus. The authors view GDP and GDI as noisy measures of the underlying latent true GDP. Their results are published regularly in the Philadelphia Fed web page. GDP Plus tends to smooth the quarterly changes. The reading for GDP plus in 1Q16 was 2.3% vs the 0.8% in the second GDP print.

GDP: looking at discretionary spending

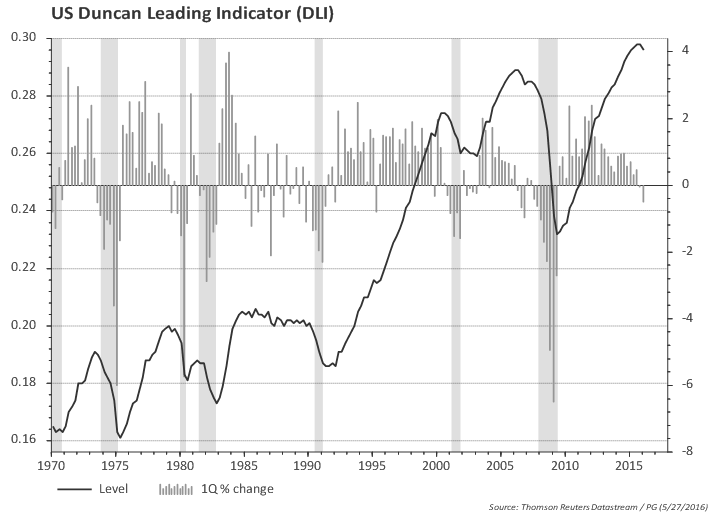

Discretionary spending often slows down ahead of a recession, and given the weakness in some recent economic and financial indicators at the turn of the year, it is interesting to look at some charts to gauge the behavior of discretionary spending.

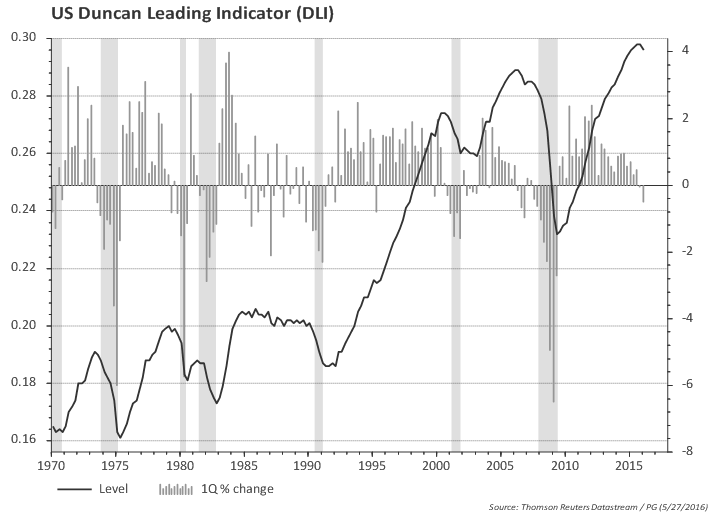

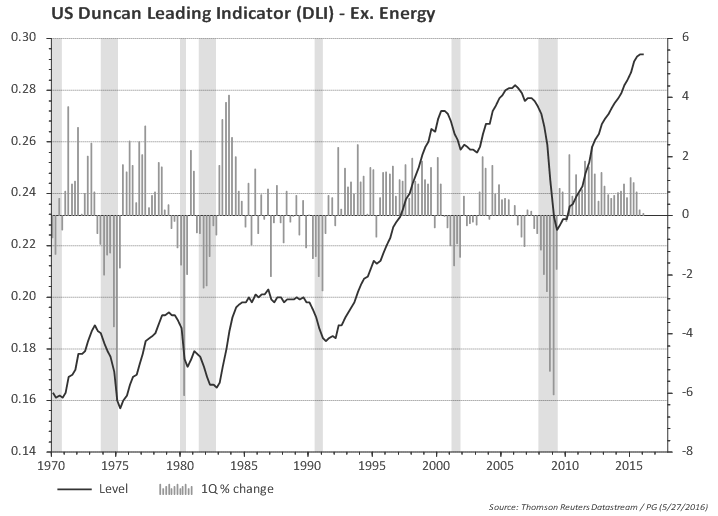

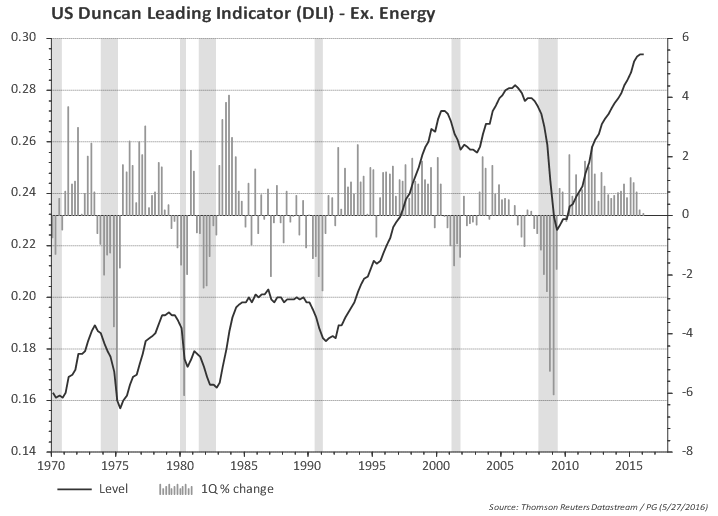

The ratio of growth in spending on consumer durables and private investment to final sales growth (the "Duncan" indicator) is a useful indicator. The chart below shows that this indicator usually turns down before the recession (shaded areas in the chart). The first chart considers total private investment and the second excludes investment in the energy sector. Both suggest discretionary spending slowed down. The indicator ex. energy has not consistently turned down, but it bears watching.

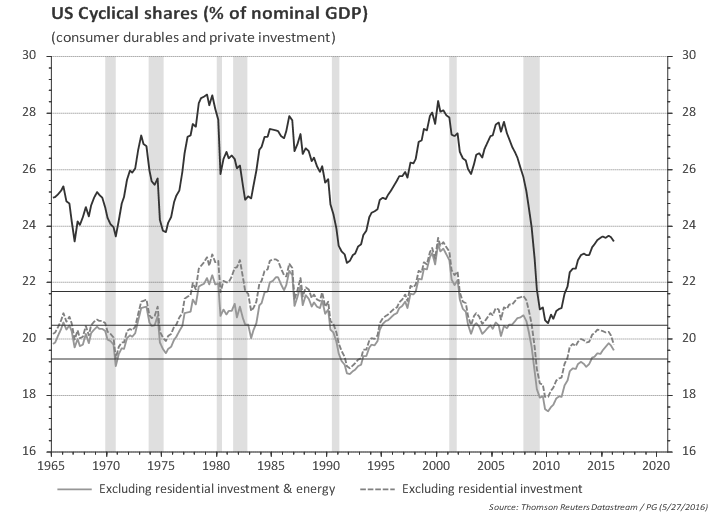

Another way to look at discretionary spending is to look at the share of the income spent on those items. The chart below highlights that consumption of durable goods and investment is still at low level as a share of income. Even excluding residential investment, it seems that there would be room for the share of discretionary spending in total income to grow. Nevertheless, it has turned south since early 2015. Even when one excludes energy, there is a down tick in both 4Q15 and 1Q16 that is important to monitor.

GDP 'residual' seasonality

Regarding 'residual' seasonality one can make a very simple adjustment by applying a simple seasonal filter to BEA's published GDP statistics. As the chart below shows, that would move 1Q GDP from 0.8% to 2.4%, more aligned with the growth of GDI reported earlier.

Inventory Cycle

The ISM data still hints at further downside to growth coming from inventory adjustment.

GDP Chart pack

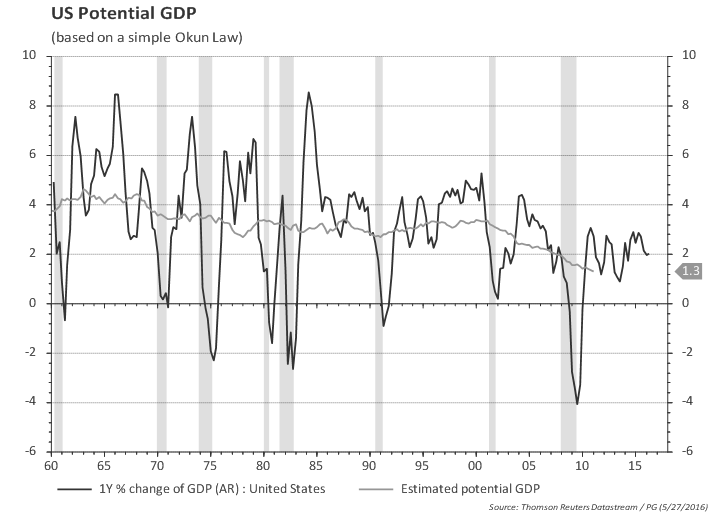

GDP growth not stellar, but is running above potential...

GDP increased 2.0% yoy in 1Q; trend in the last 2 years is 2.4%; 2Q last year was 3.9% so there is a high hurdle for keeping annual GDP at 2%.

GDP and real GDI (gross domestic income) are both growing at around 2% yoy.

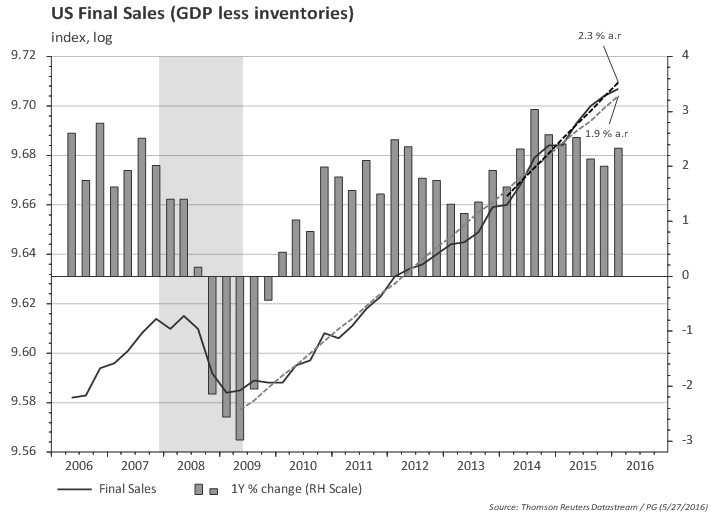

GDP excluding inventories is growing at 2.3% in the last 2 years and 2.3% yoy

The value of goods and services purchased by US residents (regardless of where goods and services were produced) excluding inventories is growing at a healthy 2.7% since 2014.

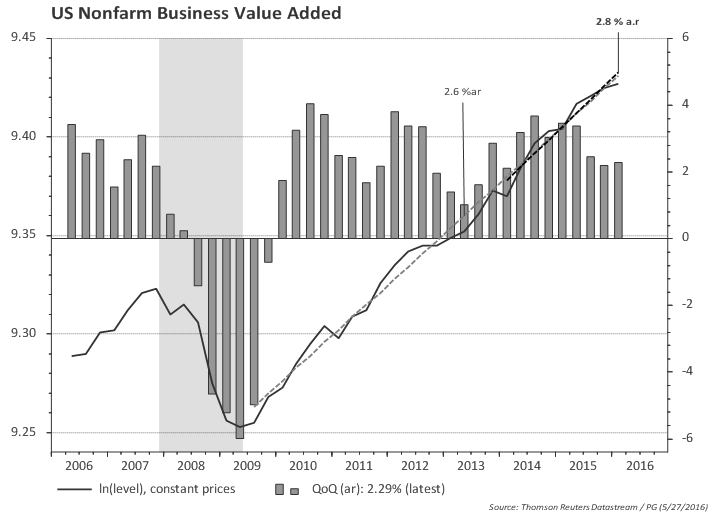

Business value added slowed to 2.3% in Q1, but overall growth since 2014 is 2.8%.

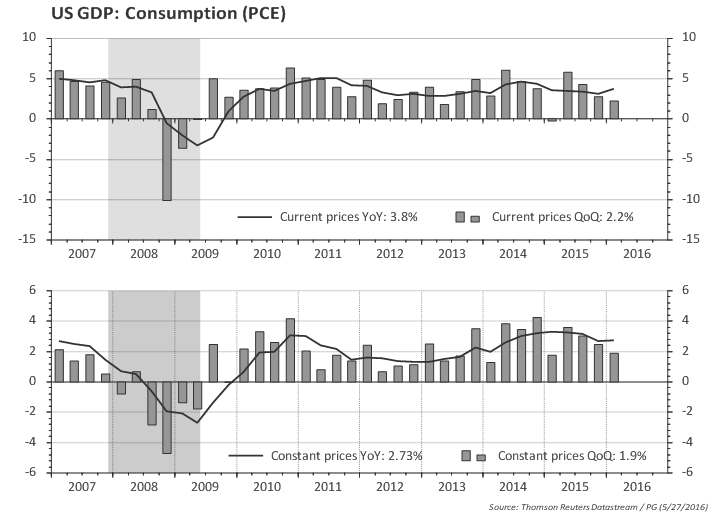

GDP breakdown: Consumption

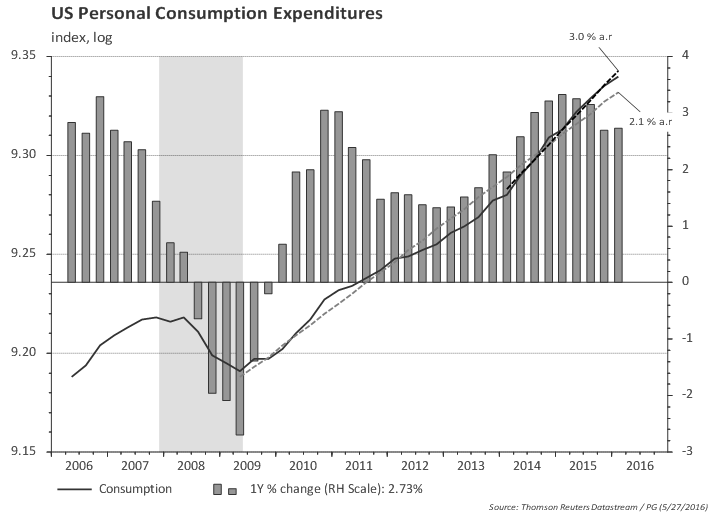

Consumption is growing at 2.7% yoy (constant prices)

Core consumption (excluding energy and food) is even a bit higher.

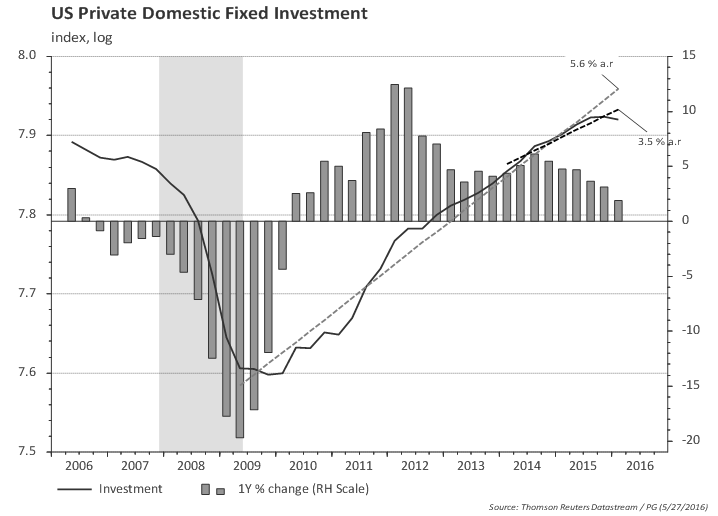

GDP breakdown: Investment

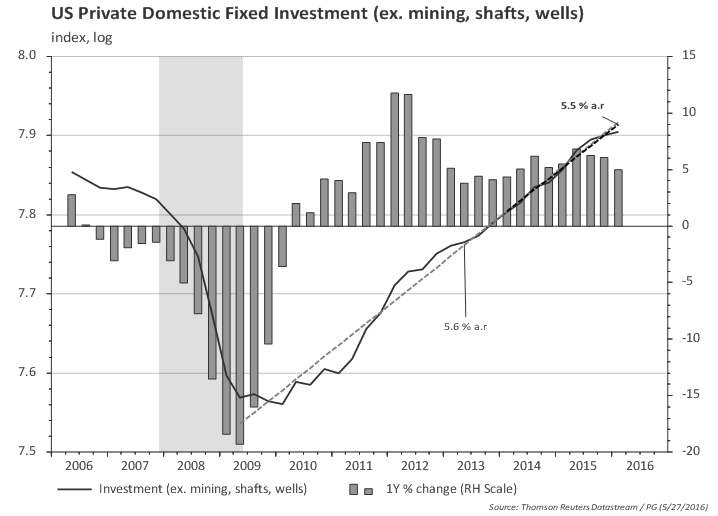

The annual pace of investment growth is slowing materially...

...and the slowdown spread to other areas outside the oil sector in the las two quarters (average 2% growth)

Excluding residential investment, one can see more clearly the slowdown in investment spreading to non-energy sectors.

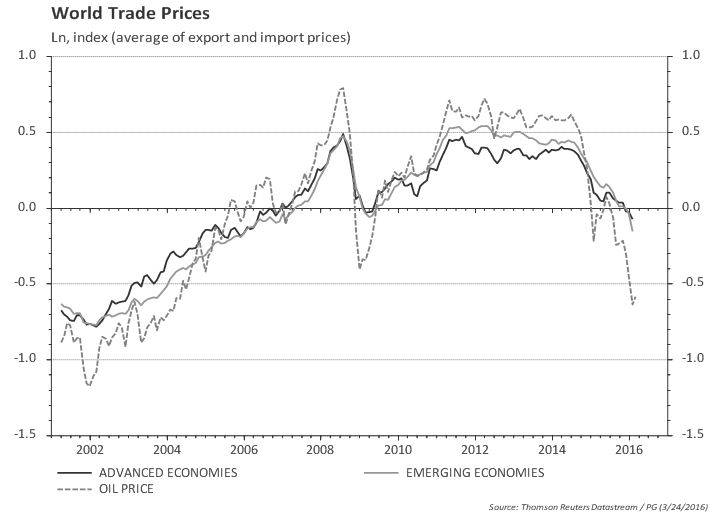

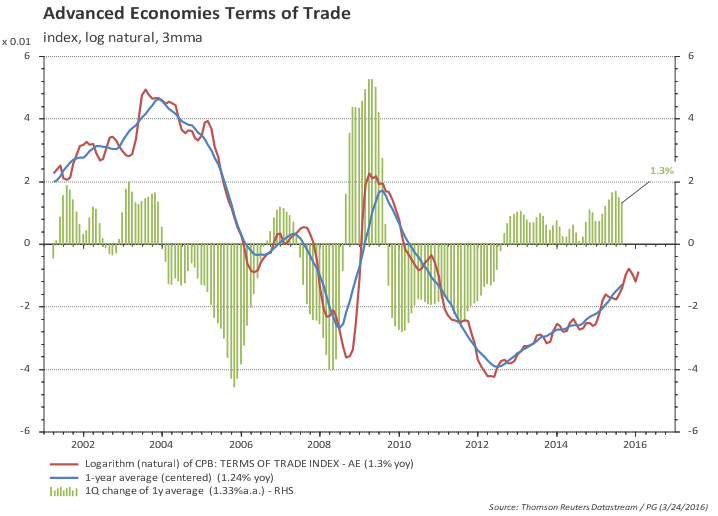

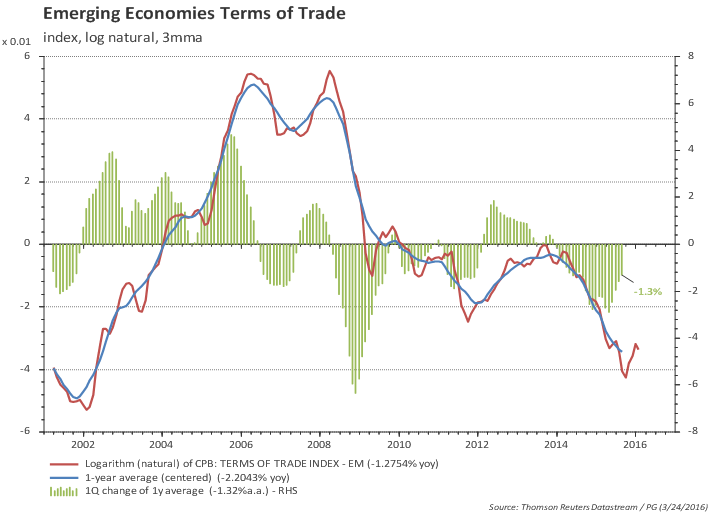

GDP breakdown: External trade

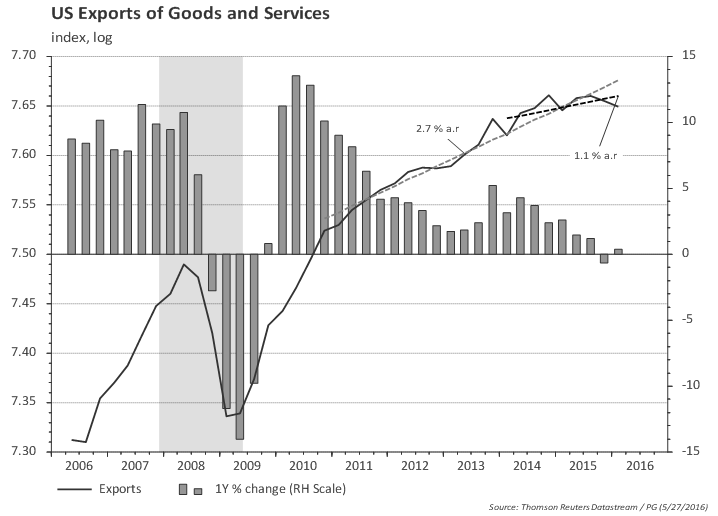

Exports flat, likely due to global growth slowdown and dollar strengthening...

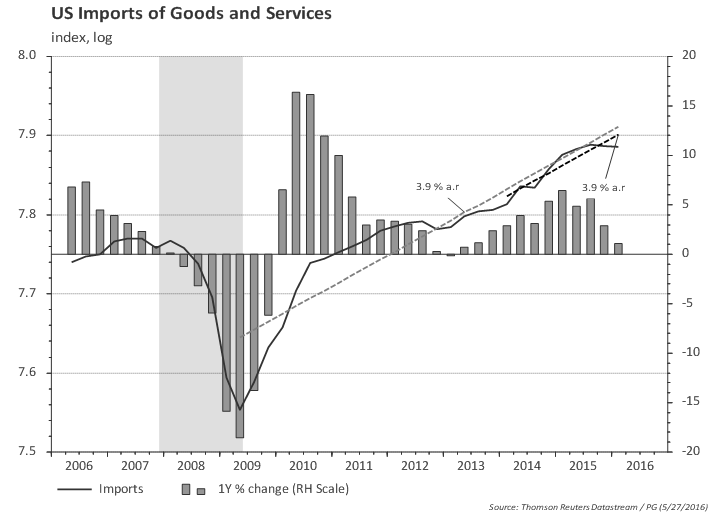

...while imports slowed down substantially in the last few quarters, since the slowdown in investment was combined with slowdown in consumption in the last two quarters.

Is the worst over for net exports?

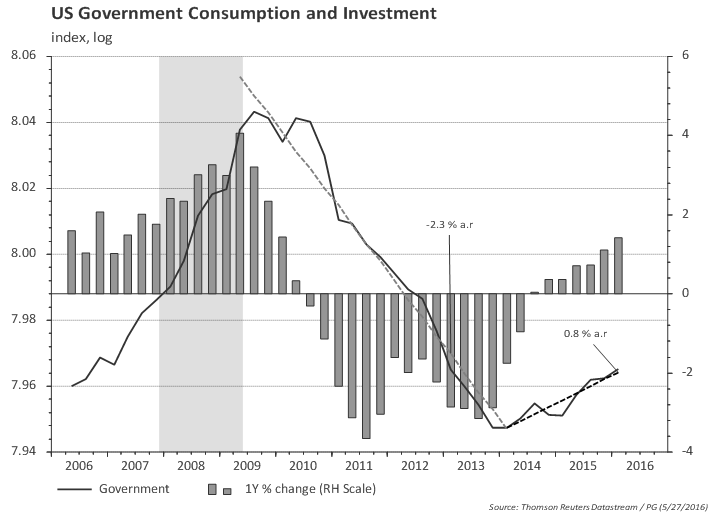

GDP breakdown: government

Government consumption and investment bottomed in 2014 and will likely continue to add to growth next year.