Main takeaways:

- Yellen's speech at the Economic Club of Washington on Dec 2 explained why she will vote for an increase in rates on December 16. There's nothing in today's job report that would make her change her mind.

- A couple of months ago I took the view Aug/Sept plunge in job creation would reverse in time for a December liftoff: "Since I believe the payroll slowdown is temporary and that global risks are likely to recede in the coming months, I think December is still the most likely date for moving out of the ZLB". That's now a consensus.

- The focus will now shift to the pace of increase thereafter, as the Fed wishes:

- "what matters for economic outlook are the public's expectations concerning the path of the federal funds rate over time" (Yellen speech).

- But FOMC expected, in September's projections, around 100bp increase / year in the next couple of years; market expects, on average, around 50-60bp per year. The FOMC could move a bit towards markets in the next meeting, but the gap will remain large.

- The risk of a very short hiking cycle is not trivial; but, barring a China colapse, I think odds are both the Fed and the markets will adjust expectations upwards by mid H1 2016.

Establishment report:

Private payroll increased 197k in November, in line with the bloomberg consensus. Net revisions were positive 52k.

The table below shows the expected range for private payroll (excluding outliers), the monthly surprise and revisions to the last 3 months. The actual print is in "red" (an "x" when inside the expected range and a box when outside).

It is interesting to see the shape of the gray area! The negative surprises in August and September led to a material downward change in market's expected range for private payroll. A positive surprise in October resulted in an opposite move.

Market has been on track forecasting the pace of job creation in the last 6 months!

(but actual number beat forecast in the last 3 months)

One can see that the average of the median expectations for the last 12 months was 212k/month, very close to the actual releases of 213k/month in the same period (after revisions, private payroll averaged 212k/month in the last 12 months).

In the last 6 months the median expectations averaged 201k/months and the actual release averaged 193k (201k/month after revisions).

In the last 3 months the median expectations averaged 188k/m and the actual release averaged 194k/month (222k/month after revisions).

Payroll trend

The trend in private payroll (measured by the 12-month moving average) moved down to 212k/month from 226k/month (unrevised) in October. The chart below shows the current vintage (orange line) as well as the real time path observed in each of the last few months.

It is clear that the pace of job creation has slowed from the excessively high pace observed in Q4 2014 and Q1 2015, but it is still well above the job growth observed in 2013 / early 2014.

The chart below shows that annual growth rate in private payroll is growing at 2.1% yoy -- off the highs but is still a healthy pace of growth.

Job growth momentum is back to neutral after spending Q2 and Q3 in the negative area.

Labor input:

The volume of total hours worked in the economy recovered from September and is back on the trend since 2009. Total hours worked increased 2.2% (annualized) in the last 3 months (blue line in the chart below).

Hours worked in the goods sector have been roughly flat in 2015. Hours worked in the services sectors continued performing well.

Wages:

Wages for all employees rose by 2.3% yoy (vs 2.4% in October) and for production worker rose 2% yoy (vs 2.2% in October). Overall, as the chart below shows, average hourly earnings have consistently grown at about 2.1% p.a in the last three years.

Household income:

Good. Close to the trend observed in the last three years.

Goods sector nominal income below trend.

Services sector income close to trend.

Household report:

The labor force participation rate ticked up in November (to 62.5% -- see chart).

It is interesting to highlight that the most LFPR managed to do was to stabilize in 2014 -- a year in which job creation and labor market conditions improved quite substantially. If the LFPR resumes its structural downtrend it could put the Fed in a position where they see labor slack shrinking faster than what they forecast, despite a similar economic growth outlook.

The broader measure of unemployment (U-6), which includes marginally attached, discouraged workers, and employed part time for economic reasons move slightly up in November, but overall it is falling faster than the headline unemployment.

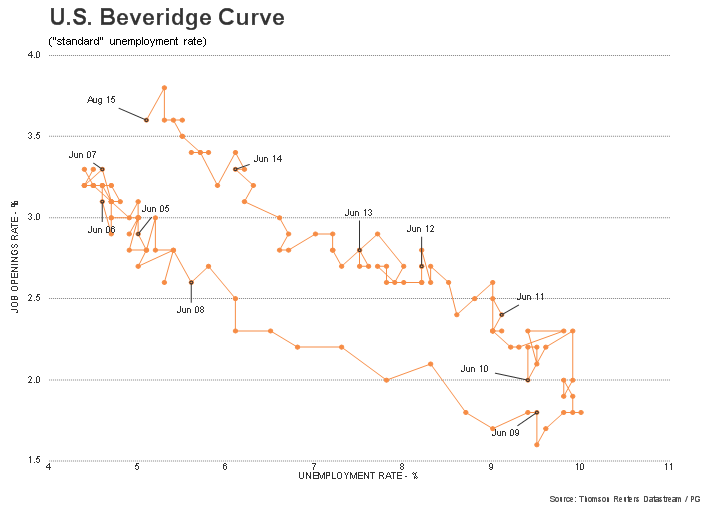

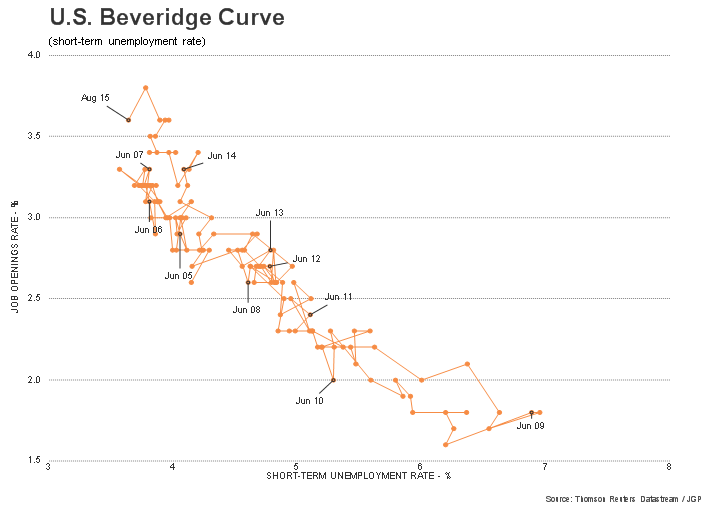

The median forecast for unemployment rate in the Fed's SEP (Summary of Economic Projections) is 4.8% for 2016, 2017 and 2018. Assuming a flat LFPR, a forecast of 4.8% unemployment rate by the end of 2016 is compatible with average employment growth of 145k/month, substantially lower than the current pace of job growth.

As a reference, even a slowdown in employment growth from 2.1% currently to 1.5% yoy (the floor observed since mid-2011 was 1.8% yoy) would be equivalent to monthly employment gains of 178k and this would lead to a 4.4% unemployment rate by the end of 2016. Bottom line: LFPR needs to rebound (or job creation to settle at a very low level) for a 4.8% unemployment forecast to be attainable.

See detailed charts below:

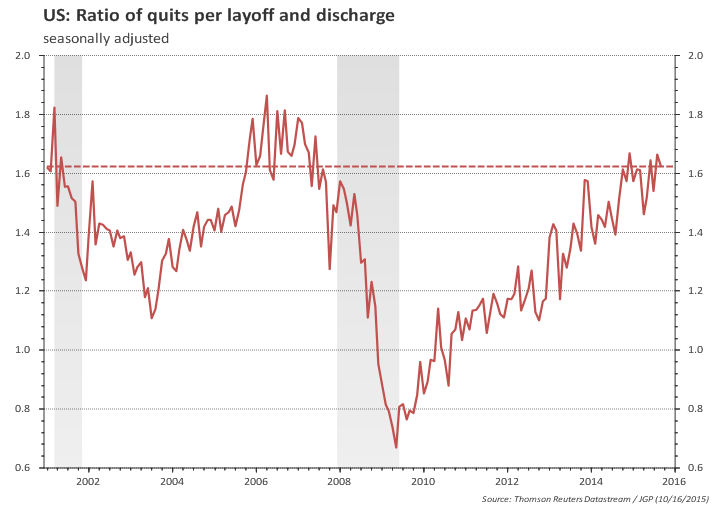

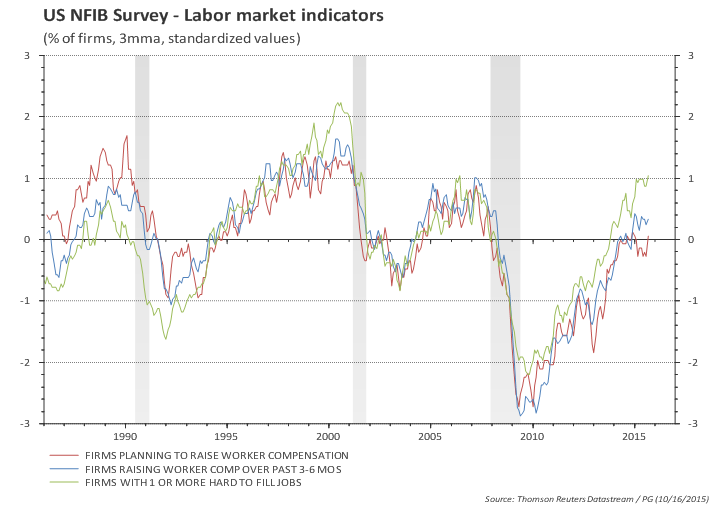

The chart below shows unemployment rate (and short-term unemployment) and the recent tightening cycles (yellow). The short-term unemployment rate is at the lows.

Long term unemployment rate is improving faster. Moreover, the 'shadow' labor (i.e., the gap between U-6 and the headline unemployment rate) is also improving faster in the recent months. This is a clear sign that the labor market continues improving.