The Q3 2015 GDP data by industry was released today. Below I've updated the two charts showing value added and gross output for the mining sector. It shows the collapse of the sector continued well into Q3.

I have compiled some key numbers of the mining sector (a broad classification, which includes oil and gas) to give some color on the importance of the sector to the broad US economy. The overall point is that the sector has collapsed in 2015 and will likely continue to contract in 2016. Despite the collapse in 2015, the broader economy has, so far, shown resilience to the crisis in the sector: GDP up by 2%, 2.6 million jobs created (220k/month average), consumer confidence close to highs, etc.

The good news is that the size of the mining sector compared to the overall economy has shrunk substantially. Therefore a similar sized collapse in 2016 would have a smaller impact in the broad economy.

The bad news is that contagion (HY market and overall tightening in financial conditions), assuming the level of stress in the market continues, can be enough to slowdown the economy substantially.

Main takeaways:

- US mining sector (which encompasses the oil and gas sector):

- investment is 0.4% of GDP (down from 0.9%);

- value added is 1.9% of GDP (down from 2.7%);

- gross output is 2.5% of GDP (down from 4.1%);

- employment is 0.5% of total employment (down from 0.6%);

- employment is 730 thousands (down from 860 thousands).

- Real activity:

- investment fell 45% in three quarters since 2014 (-55% annualized)

- this subtracted 0.25 percentage points from the 2.15% GDP growth observed in the last four quarters to Q3 2015.

- Spillover:

- a rough calculation (based on employment in the oil-producing vs non oil states) suggests that for each job lost in the mining sector another one was lost outside the sector (one-to-one spillover);

- if mining employment goes back to 500-550 thousands observed before the boom (2004) that would imply an additional loss of 180k-230k jobs;

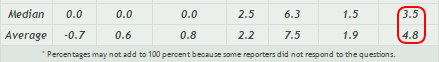

- assuming a one-to-one spillover that would imply total job losses in the 360k to 460k range; wage income loss (based on an average annual individual income of $57.5 thousands) would amount to a mere 0.1% of GDP.

- Debt of energy/mining companies:

- Total debt of the energy and mining companies in the S&P500 is $410bn (out of which $40bn is short-term);

- total debt of energy companies with coverage ratio below 2 is $225bn;

- about $100bn debt of "really junk" companies (rating below CCC+);

- median debt to equity ratio for the oil sector is around 50% (up from 40% in 2013), with 10 with debt/equity ratio above 80; median debt/equity for the S&P is 80 (up from 60);

- cashflow from operating activities (for S&P500 oil and mining companies) dropped from $230bn in 2014 to $155bn in 2015; this compares to gross operating surplus (from BEA data) going from around $300bn in 2014 to $200bn in 2015.

- HY debt and financial conditions

How big is the oil/mining sector?

Investment on mining exploration, shafts, and wells structures peaked at 30% of the total nonresidential investment in structures, but has already dropped to 15% (Obs: this sector is broader than just the oil & gas).

However, investment on the sector is much smaller when compared with overall investment or GDP. Mining exploration, shafts, and wells structures account for 2.5% of total investment (down from 5.7%) and for 0.4% of GDP (down from 0.9%).

Both the increase since early 2000 and the recent drop are not a merely a price effect -- when comparing quantities it is also clear that the volume of investment in the sector outpace the overall volume of nonresidential investment in structures from 2000 to 2011 and has now underperformed materially since 2014.

The chart below shows that the high frequency data on rig count is a good proxy for the investment in the sector; and it suggests further downside in the near term.

GDP measured via the product approach is released with a delay and the most recent data refers to Q2 2015. Data is only available (quarterly) for the mining sector, which is broader than the oil sector. Value added in the oil and gas extraction sector accounts for about two-thirds of the broader mining sector. The chart below shows that the value added by the mining sector amounts to 1.9% of GDP, down 0.8 percentage points from the 2.7% peak in mid-2014.

But value added does not account for the sector spending on intermediate inputs (materials, services). For the mining industry, intermediate inputs are roughly 45% of the value added (a bit lower for the oil sector alone: 35%). The chart shows that gross output of the mining sector amounts to 2.5% of GDP, down 1.6 percentage points from the recent peak in mid-2014.

Employment

There are currently around 185 thousands employed in the oil and gas extraction sector, down from 200 thousands by late 2014. This represents a mere 0.1% of total employment. Even though the oil and gas industry accounts for about two-thirds of gross output in the mining sector (and two-thirds of value added) it accounts for a much lower share of total employment (25%). Total employment in the mining sector fell from 860 thousands to 730 thousands in one year (and now accounts for 0.5% of total employment). Before the boom, mining employment was 500 thousands (0.4% of total employment).

Another way of looking at the impact of the mining crisis in employment and its potential spillovers is to split the US states in oil producing vs non-oil states.

The chart below clearly shows that employment growth in the oil producing states has slowed since late 2014. Total employment in the oil producing states, however, is much smaller than the overall employment in non-oil states (25 million vs 118mn).

If employment in the oil producing states (outside of the mining sector) had moved in tandem with employment in the non-oil states, then employment in the non-mining sector of the oil states would be around 140 thousands higher than what is currently observed (or an average of 12k/month). Comparing this with the loss of employment in the mining sector (130 thousands) one can guess that the spillover to employment in other sectors was large (about one-to-one). The good news is that the counterfactual (i.e., the employment growth without the oil / mining crisis) would have been 2.9 million in 2015, rather than the 2.6 million reported.

If employment in the mining sector goes back to levels before the boom, around 500-550 thousands (depending on whether the low is measured in absolute or relative to total employment), that would imply an additional loss of 180k-230k jobs on top of the 130k loss reported in 2015.

Assuming the same spillover reported above, that would imply total job losses in the 360k-460k range. If this loss happens over a one-year period it would reduce job growth from the 2.9 million pace (counterfactual) to 2.4 million (substantial, but still a healthy 200k/month monthly payroll !!).

Even doubling the spillover (2 jobs for each job loss in the mining sector), the outcome would be job growth of 2.2 million (185k/month) !

Note:

Off course it all depends on the counterfactual job growth of 2.9 million / year, which is 2% yoy growth. If the counterfactual (or underlying growth, not related to the mining direct and/or indirect impact) slows down to, say, 1.5% yoy, then average monthly payroll would be in the 120k-140k per month ballpark.

Income

The average mining worker earns $1250/week and works 46 weeks/year, taking home an annual pay of $57,500. If, as assumed above, 200 thousands mining workers lose a job, that will represent a loss of $11.5bn in total wages. Even accounting for the one-to-one spillover mentioned above, the total wage loss would amount to $23.6bn, a mere 0.1% of GDP.