Main takeaways:

- Very weak report, across the board; median expectations for private employment growth averaged 204k in the last three months and the actual number was 138k (lowest since mid-2012, right before QE3... if only Bernanke was there... :-)

- Job creation in goods sector had already been weak since earlier this year, but job creation in the services sector slowed materially in the last couple of months.

- Is this the spillover from the industrial sector (oil, exports, etc.) into the services sector or just a temporary halt in new hiring due to global uncertainty?

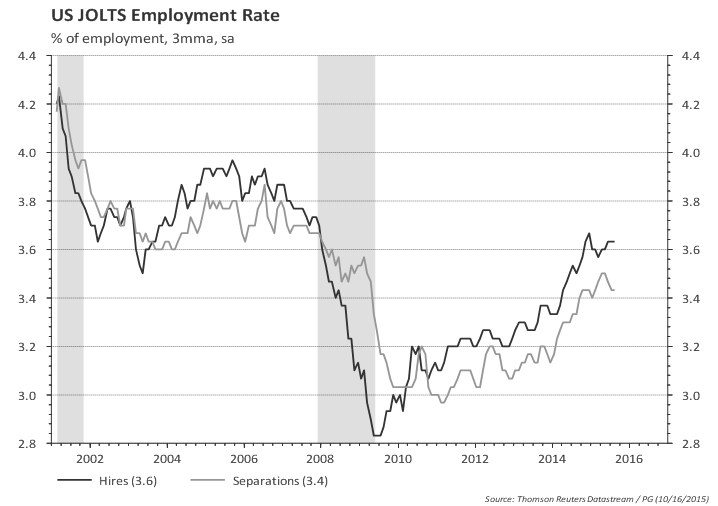

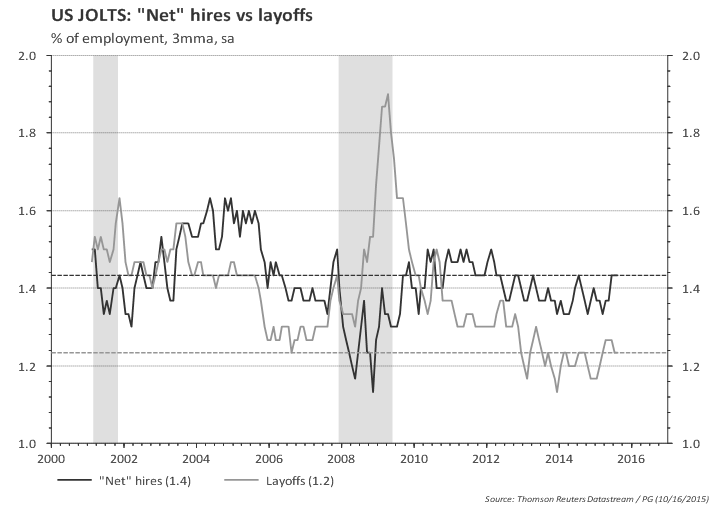

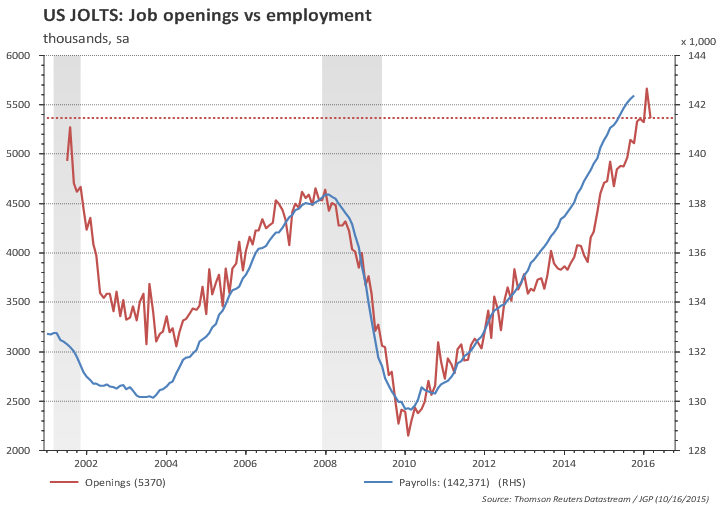

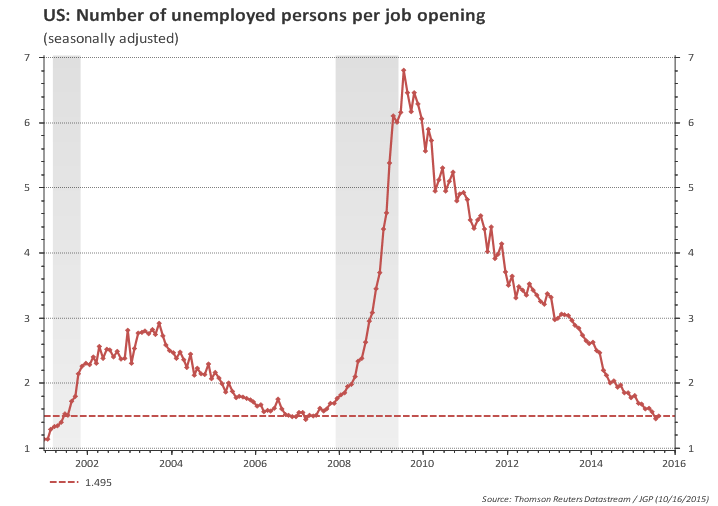

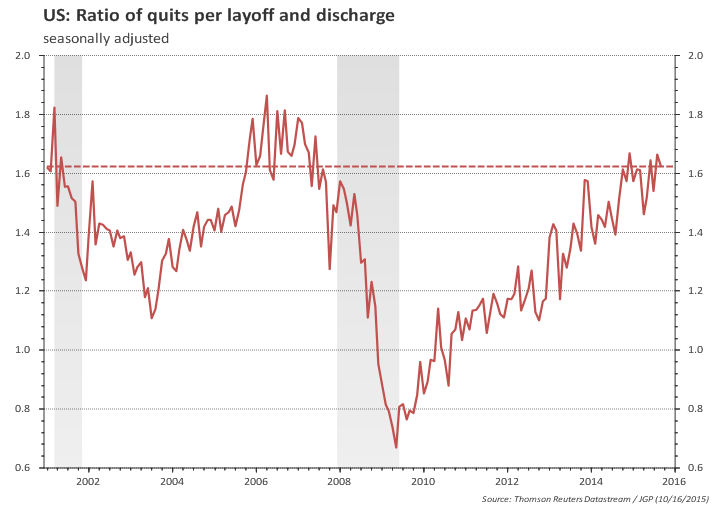

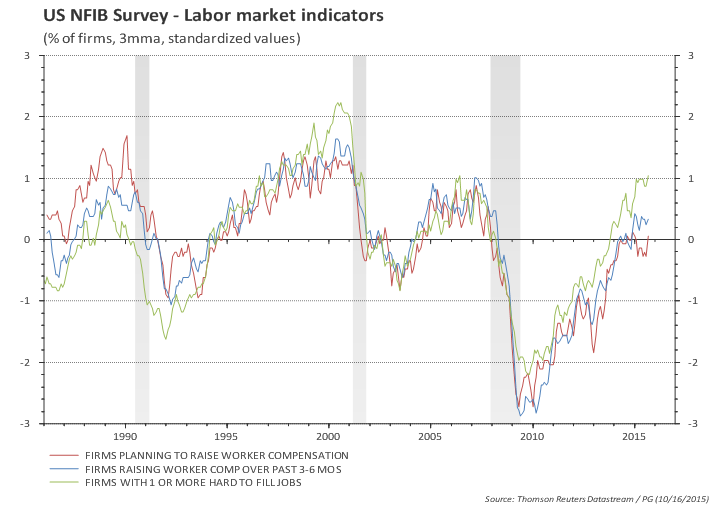

- Low unemployment claims suggest layoffs are not increasing and a combination of measures of labor market activity (see below) suggest it might be the later.

- The contradictory message in this report is that, while job creation has slowed, measures of labor slack kept shrinking.

- Particularly worrying it the decline in labor force participation (LFPR), which seems to be back to the trend observed from 2010 to 2013 (LFPR stabilized in 2014, a year in which labor market improved materially).

- If LFPR remains flat a mere 145k/month payroll for the next 15 months is needed to reach the 2016 median unemployment forecast; if employment growth slows from the current 2.2% to 1.5%yoy and LFPR remains constant (against structural trend), then unemployment rate would reach 4.5% by the end of 2016. Allowing the LFPR to continue its down trend since 2010, 145k/month would lead unemployment rate to 3.8% by the end of 2016.

- As for the timing of liftoff...who knows... the Fed keeps hinting at December but, fears of a more serious growth slowdown in the US has now been added to the China risk and tightening of financial conditions. Since I believe the payroll slowdown is temporary and that global risks are likely to recede in the coming months, I think December is still the most likely date for moving out of the ZLB.

Establishment report:

Private payroll increased 118k in August, well below the bloomberg consensus again. Net revisions were negative 69k.

The table below shows the expected range for private payroll (excluding outliers), the monthly surprise and revisions to the last 3 months. The actual print is in "red" (an "x" when inside the expected range and a box when outside).

There were 4 large negative surprises in the last 18 months: Aug/14, Mar/14, Aug/15, and Sep/15.

Market has clearly missed the pace of job creation in the last 3 months!

One can see that the average of the median expectations for the last 12 months was 219k/month, very close to the actual releases of 218k/month in the same period (after revisions, private payroll averaged 217k/month in the last 12 months).

In the last 6 months the median expectations averaged 214k/months and the actual release averaged 194k (179k/month after revisions).

In the last 3 months the median expectations averaged 204k/m and the actual release averaged 156k/month (138k/month after revisions).

Measurement error in August?

After August disappointment, a strong emphasis was given to the fact that, since 2009, August payroll had always been revised higher (see chart) -- but the opposite happened this time.

The trend in private payroll (proxied by the 12-month moving average) moved down to 217k/month from 232k/month (unrevised) in August. The chart below shows the current vintage (orange line) as well as the real time path observed in each of the last few months.

The chart below shows that annual growth rate in private payroll is growing at 2.2% yoy -- off the highs but is still a healthy pace of growth.

September annualized growth (1.2%) is close to the recent lows -- which in the recent past proved to be transitory. The current yoy growth (2.2%) continues very close to the growth observed in private payroll in the last 3 years, which is above the peak observed in March/2006 during the previous expansion period and is closer to the growth rate observed in the late 1990´s.

Labor input:

The volume of total hours worked in the economy contracted in September resulting in an annualized contraction of 0.4% in the last 3 months (blue line in the chart below). This is well below the main trend (since Oct/09) which remains at 2.3%. There were several episodes of a similar sharp slowdown in total hours worked since the crisis: Oct/10 to Jan/11, Jan/12 to Jul/12, Feb/13 to Jul/13, Nov13 to Feb/14, Dec/14 to Apr/15, and the last one starting in June.

Contraction in mining and weak manufacturing are behind the stagnation in hours worked in the goods sector.

Hours worked in the services sectors slowed down a bit.

Wages:

Wages (average hourly earnings) were flat in September.

Wages for all employees rose by 2.2% yoy and for production worker rose 1.9% yoy - stable compared to August. Overall, as the chart below shows, average hourly earnings have consistently grown at about 2% p.a in the last three years.

Household income:

Total payroll income for production workers contracted sharply in September (-3.6% ar). For all employees, payroll income dropped 2.9% annualized in the month. Payroll income in the goods sector was negative in a quarter for the first time since 2010.

Below the breakdown in goods and services sector.

Household report:

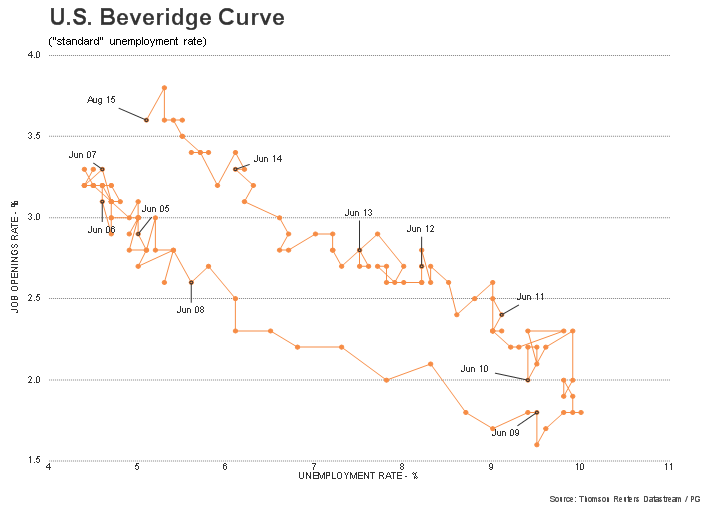

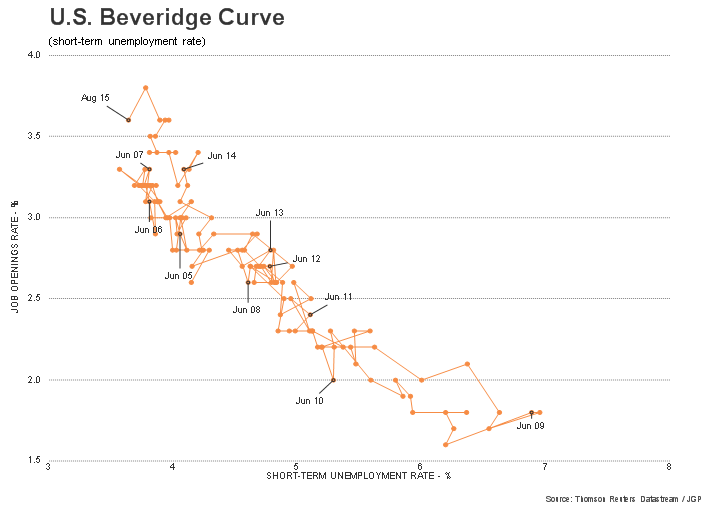

The labor force participation rate moved 'sharply' down in June to 62.4%, breaking what had appeared to be a stable level. It is interesting to highlight that the most LFPR managed to do was to stabilize in 2014 -- a year in which job creation and labor market conditions improved quite substantially. Will LFPR resume its structural downtrend now that the economy appears to be weakening? This is a crucial question as it could put the Fed in a position where they see labor slack shrinking further at the same time that the economic growth slows.

The broader measure of unemployment (U-6), which includes marginally attached, discouraged workers, and employed part time for economic reasons is falling faster than the headline unemployment -- more on that in the spider charts below.

The median forecast for unemployment rate in the Fed's SEP (Summary of Economic Projections) is 4.8% for 2016, 2017 and 2018. Assuming a flat LFPR, a forecast of 4.8% unemployment rate by the end of 2016 is compatible with average employment growth of 145k/month, even lower than the 167k/month of total payroll observed in the last 3 months (which was way on the weak side -- if a recession does not happen).

As a reference, even a slowdown in employment growth from 2.2% currently to 1.5% yoy (the floor observed since mid-2011 was 1.8% yoy) would be equivalent to monthly employment gains of 178k and this would lead to a 4.5% unemployment rate by the end of 2016. Bottom line: LFPR needs to rebound (or job creation to settle at a very low level) for a 4.8% unemployment forecast to be attainable.

See detailed charts below:

The chart below shows unemployment rate (and short-term unemployment) and the recent tightening cycles (yellow). The short-term unemployment rate is at the lows.

Long term unemployment rate is improving faster. Moreover, the 'shadow' labor (i.e., the gap between U-6 and the headline unemployment rate) is improving faster in the recent months. This is a clear sign that the labor market continues improving.

Spider charts:

The two spider charts use 13 measures of labor market activity. The first chart shows how far away the labor market is from conditions that prevailed when employment was at its postrecession low and how close to conditions that prevailed when employment was at its prerecession peak. The second chart converts the upward trending indicators in the first chart to rates. (Source: Atlanta Fed --

details here)

The charts below compare the 13 measures of labor market in July/2015 and Sept/2015. It shows that, despite the sharp slowdown in net job creation in the last two months (payroll), the overall market conditions improved in the period. Note also that Yellen's preferred measures of labor market utilization (e.g., part time for economic reasons, marginally attached) continued to improve in the last couple of months.

Levels chart:

Rates chart: