Main takeaways:

- FOMC hinted the most likely meeting for liftoff is December.

- Yellen message was: FOMC has not "fundamentally altered its outlook", the risks remain balanced, but uncertainty increased; thus...

- ...FOMC wants more evidence to bolster its confidence inflation will return to 2%.

- However, the message was conveyed in a very dovish framework that sounded like a departure from the previous reaction function.

The FOMC surprised with a clear "dovish hold". The question is, why?

The quick answer comes straight into the statement:

"Recent global economic and financial developments may restrain economic activity somewhat and are likely to put further downward pressure on inflation in the near term."

A more explicit link from global developments to domestic developments is provided in Yellen's prepared remarks at the press conference:

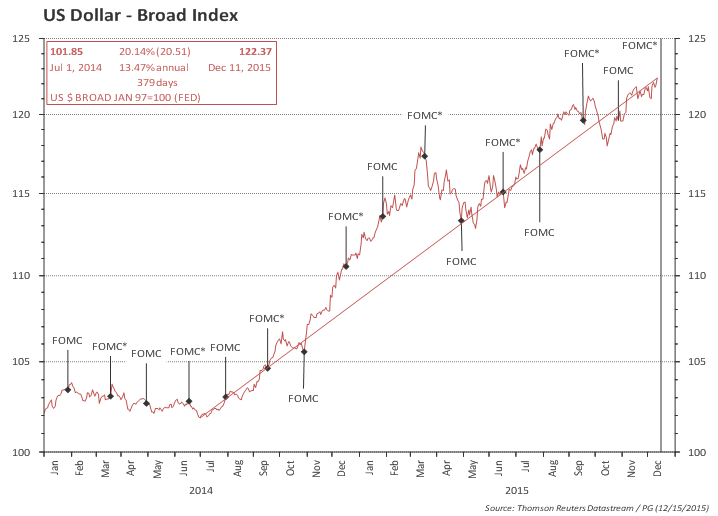

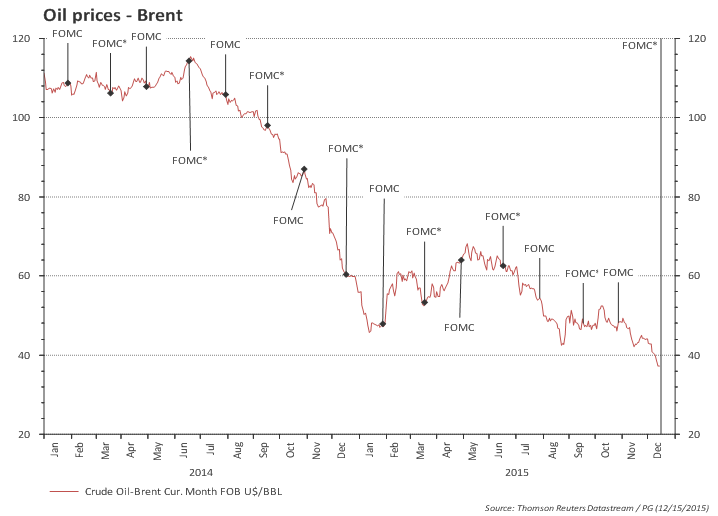

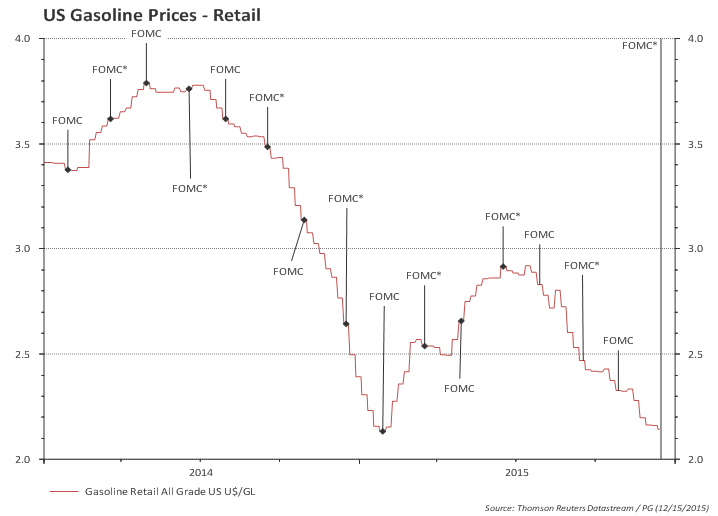

"My colleagues and I continue to expect that the effects of these factors on inflation will be transitory. However, the recent additional decline in oil prices and the further appreciation of the dollar mean that it will take a bit more time for these effects to fully dissipate."

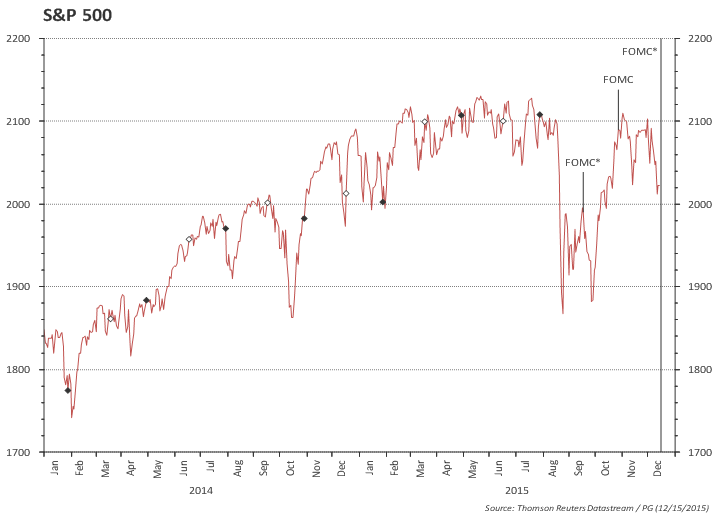

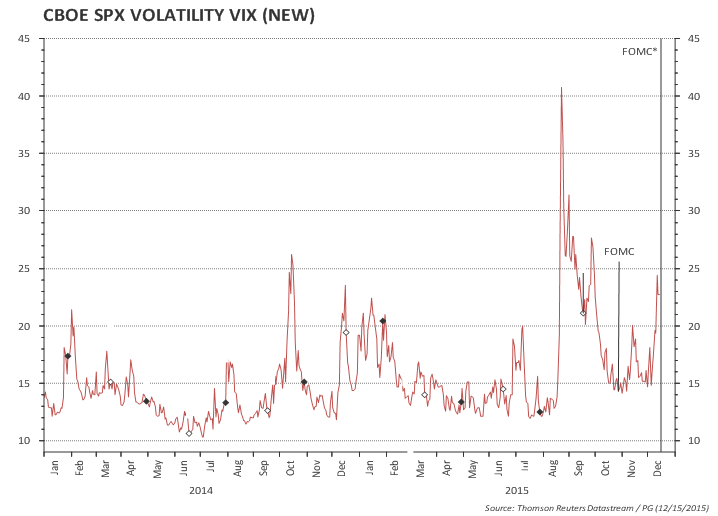

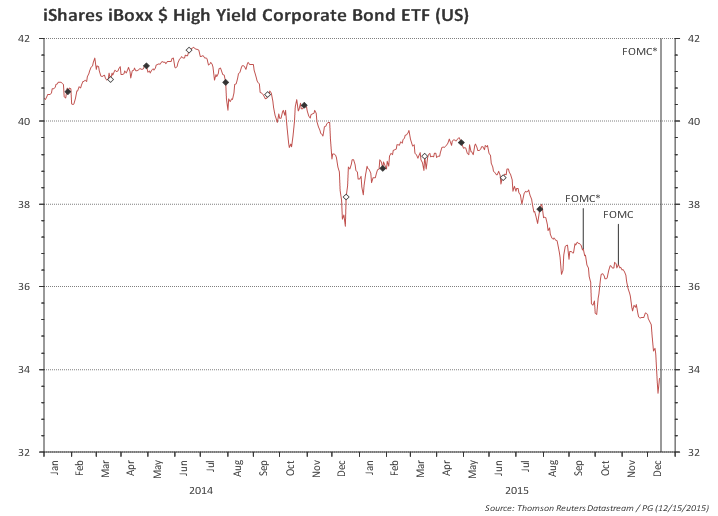

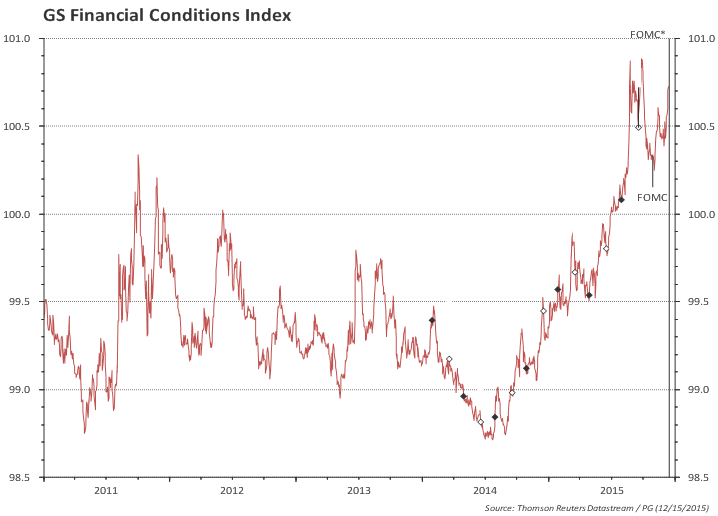

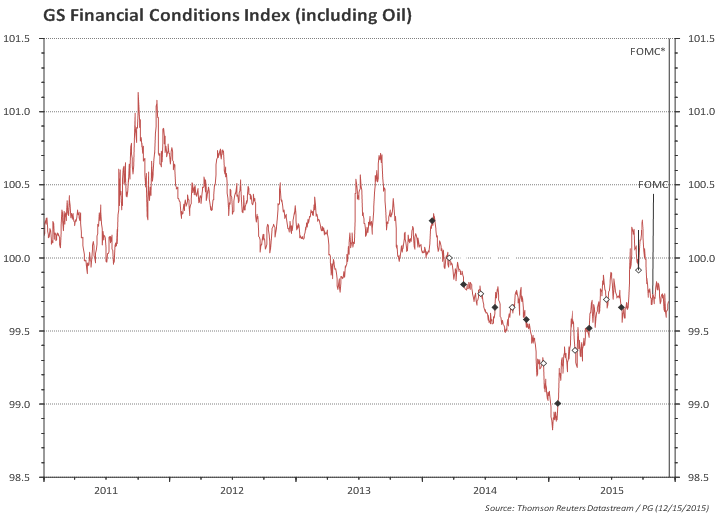

In another passage of her prepared remarks, Yellen explained what has made FOMC to change stance: equity prices, stronger dollar and spreads.

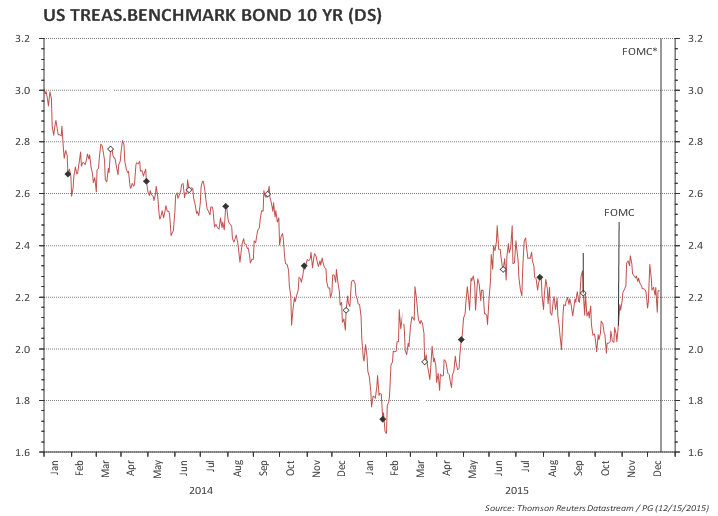

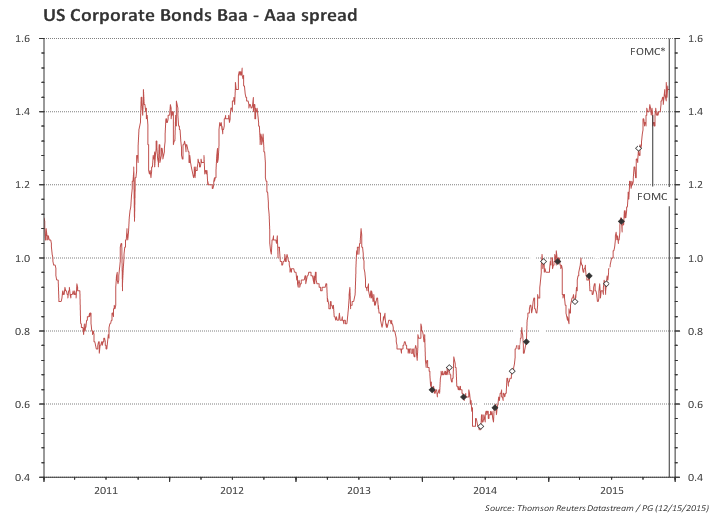

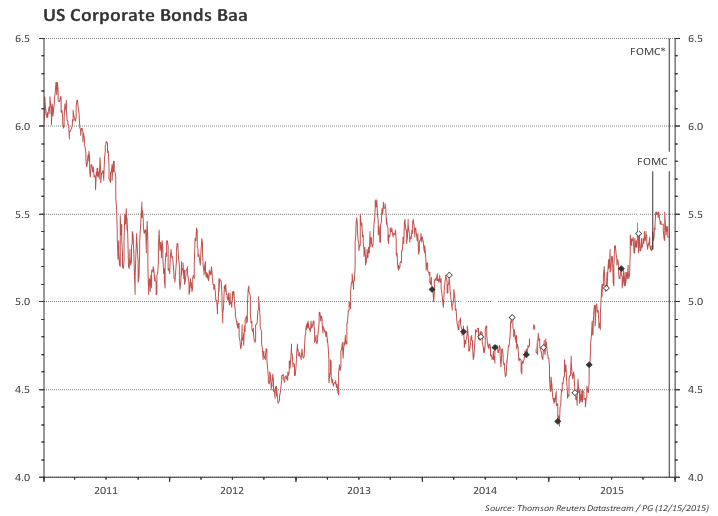

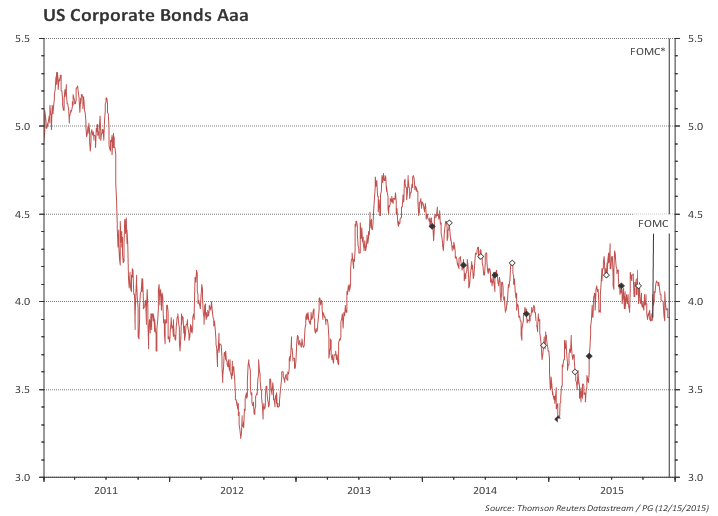

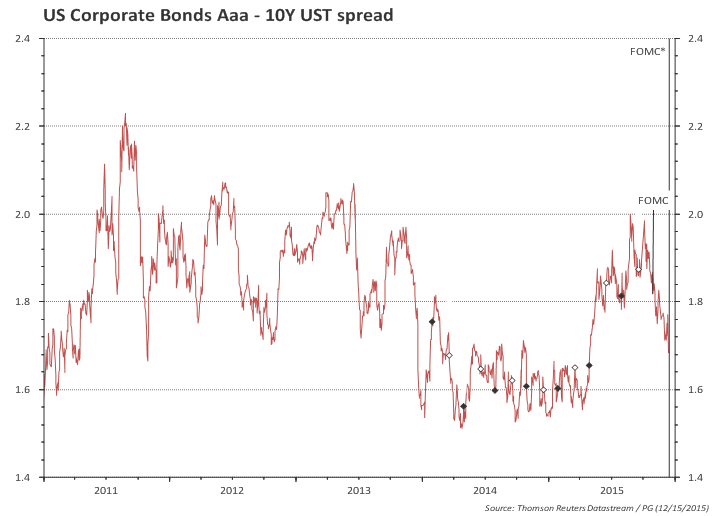

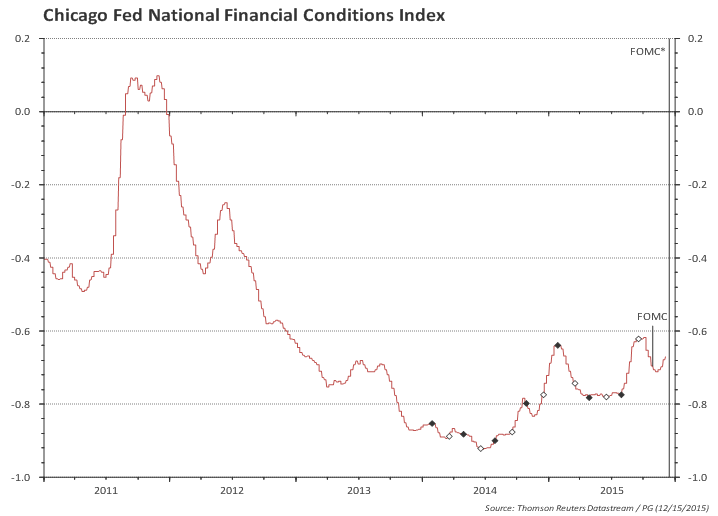

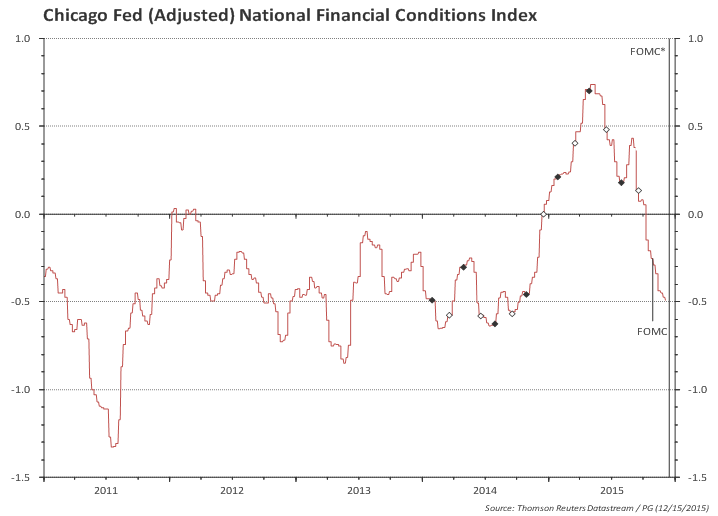

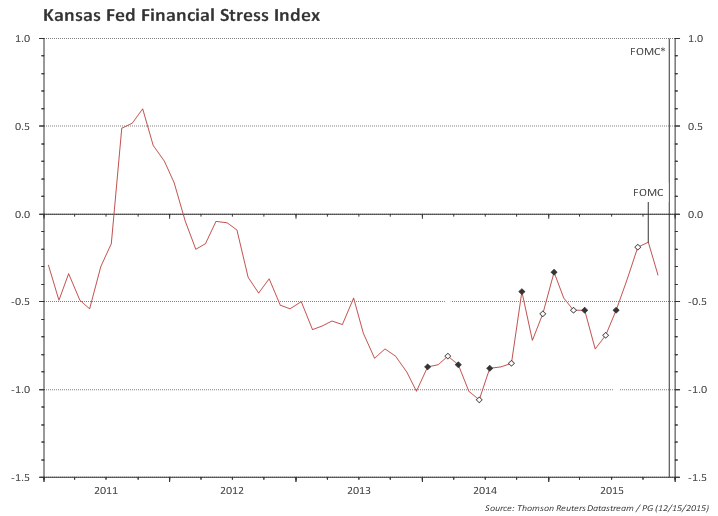

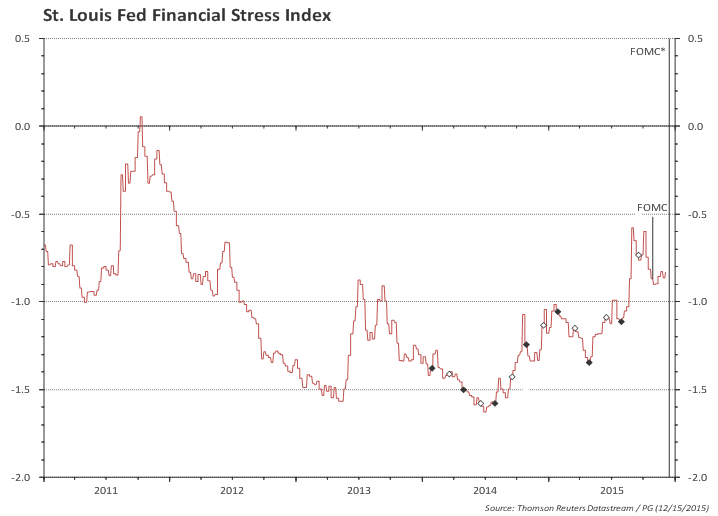

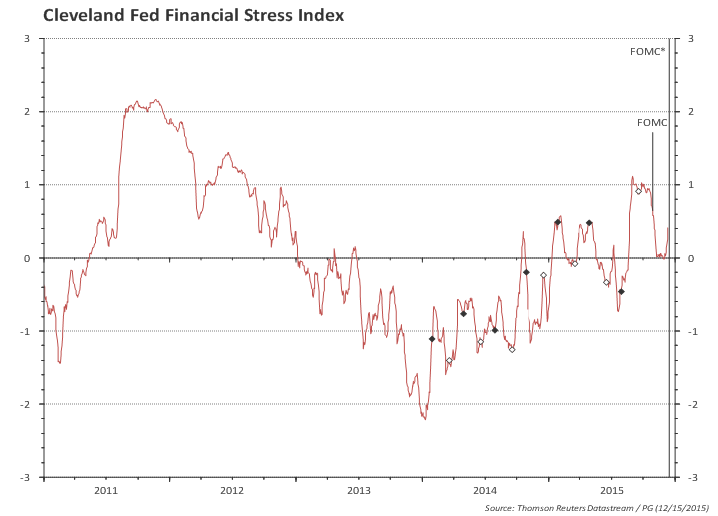

Developments since our July meeting, including the drop in equity prices [-5%], the further appreciation of the dollar [2%], and a widening in risk spreads [20bp], have tightened overall financial conditions to some extent. These developments may restrain US economic activity somewhat and are likely to put further downward pressure on inflation in the near term."

Note: the numbers in [ ] were not mentioned by Yellen.

So should we just focus on financial conditions? Not so fast... the Fed claims it does not target financial conditions... during Q&A Yellen stated:

"The Fed should not be responding to the ups and downs of the markets and it is certainly not our policy to do so. But when there are significant financial developments, it's incumbent on us to ask ourselves what is causing them ... And so they have concerned us in part because they take us to the global outlook and how that will affect us."

Ok. Now I got it. The FOMC has changed its global outlook and therefore its US outlook. No...read a bit further:

"...these recent developments...have not fundamentally altered our outlook. The economy has been performing well, and we expect it to continue to do so."

And then she mentions that "to be clear":

"...our decision will not hinge on any particular data release or on day-to-day movements in financial markets. Instead, the decision will depend on a wide range of economic and financial indicators and our assessment of their cumulative implications for actual and expected progress toward our objectives."

Then she added:

"The recovery from the Great Recession has advanced sufficiently far, and domestic spending appears sufficiently robust, that an argument can be made for a rise in interest rates at this time. We discussed this possibility at our meeting."

Ok. Now it is clear !! The US economy is so close to a rise in interest rates that the Committee has decided to send a very dovish message...go figure.

To be fair, Yellen mentioned that the "Committee judged appropriate to wait for more evidence...to bolster its confidence that inflation will rise to 2 percent".

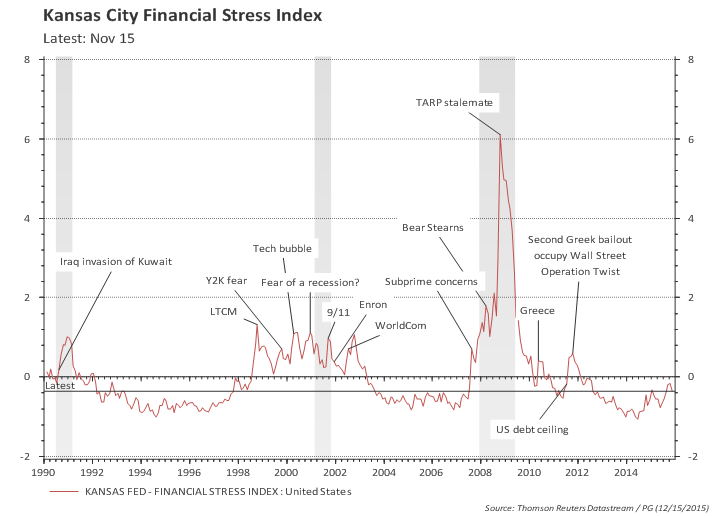

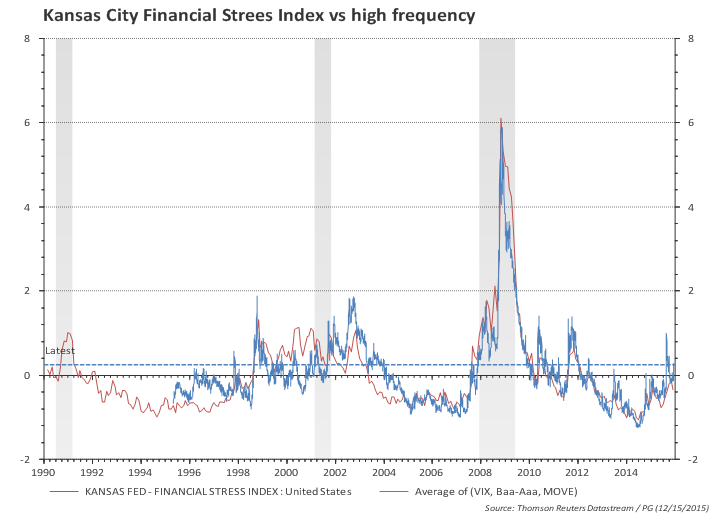

It seems, thus, that despite the dovish message, the FOMC just wants to wait a bit more to make sure the recent bout of volatility will indeed only have temporary effects on the economy.

That might be the case...but it wasn't the message that came across from the statement, from Yellen's prepared remarks and from the Q&A.

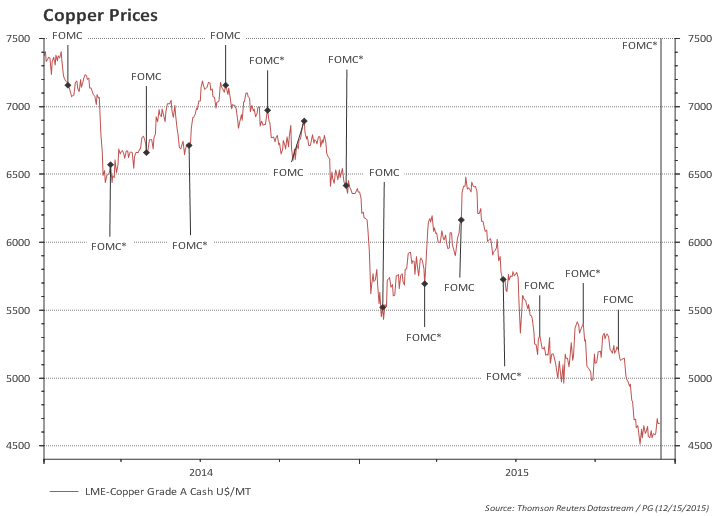

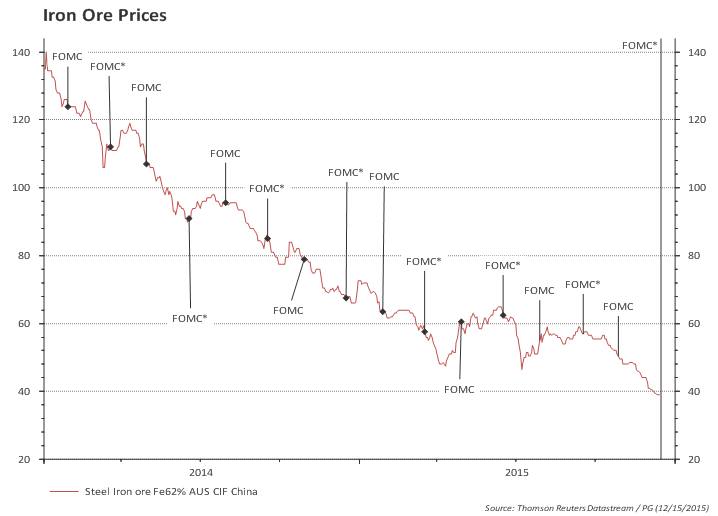

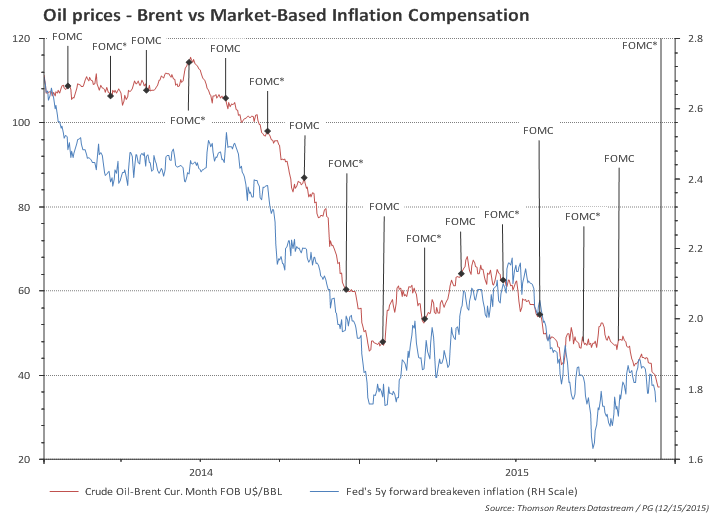

The emphasis on (previously disregarded) market-based inflation compensation, explicit concerns about Chinese growth, the impact of commodity prices on emerging market economies, the capital flight from EM, and even concerns about Canada "which is an important trading partner", all departed from the message conveyed in a similar bout of uncertainty earlier this year and sounded very dovish.

Indeed, from late 2014 to earlier this year, the Fed watched a sell-off in EM currencies, a decline in oil and other commodity prices, a strengthening of the US dollar, a sharp drop in market-based measures of inflation compensation, a sharp slowdown in global trade, West Coast port slowdown, a contraction in first quarter GDP growth,..., and the message conveyed back then was more upbeat.

One thing that stood out was Yellen's remarks on inflation compensation:

"...the Committee has taken note of the recent declines in market-based measures of inflation compensation and will continue to monitor inflation developments carefully."

This was a complete departure from the line of thought of late 2014 and earlier this year!

Back then the FOMC decided to focus on

survey-based measures of inflation expectations and disregarded market-based measures of inflation

compensation. In February

Semiannual Monetary Policy Report to Congress Yellen mentioned that inflation

compensation "mainly reflects factors other than a reduction of longer-term inflation expectations". Fed staff even prepared a box in the Monetary Policy Report explaining the "challenges in interpreting measures of longer-term inflation expectations" from financial instruments.

To be fair, when speaking by herself (and not on behalf of the Committee), Yellen often seemed more concerned about inflation compensation than the full FOMC.

Allow me a digression to show how inflation extracted from the TIPS for the 5 year period from 2020 to 2025 is correlated with today's oil prices!!

(And, by the way, market-based measures of inflation compensation today are not far away from where they were back in February 2015 when Yellen spoke to the Congress.)

Returning to the main point, it is clear that the FOMC is worried about inflation and that something has changed.

One can clearly see that in their forecasts!!

Don't you think a tenth down change in median forecast and in the central tendency range for inflation reflect a material change? Well, you've got company. It is very hard to argue that a tenth move is not well within any forecast error margin...

But, what about the move in headline PCE down from 0.7% to 0.4%? Well, that's really a large shift, but note that the core PCE rose from 1.3% to 1.4%. Moreover, would the FOMC make today's monetary policy based on the forecast for the next 3 months? Even Yellen believes monetary policy has lags..."But there are lags in the impact of monetary policy on the economy" she answered in the Q&A.

So, if the FOMC has not materially changed the forecasts, has the dovish message resulted from a change in the balance of risks? The statement reads:

"The Committee continues to see the risks to the outlook for economic activity and labor market as nearly balanced but is monitoring developments abroad."

It seems the risks remain balanced but worth monitoring; so has uncertainty increased?

Yellen mentioned in the prepared remarks that "the outlook abroad appears to have become more uncertain of late, and heightened concerns about growth in China and other emerging market economies have led to notable volatility in financial markets".

So it seems that an increase in uncertainty was behind the change to a more dovish stance. But what is odd is that this uncertainty is not reflected in the forecasts. Look at GDP, unemployment and inflation forecast in the table above: forecast ranges have not changed materially from June -- this does not reflect an increase in uncertainty (or the Fed was not brave enough to change forecasts and acknowledge the worsening of the outlook and increased uncertainty).

So, the Fed has not materially changed the outlook, neither the balance of risks, but has acknowledged an increase in uncertainty. And if one is not willing to show this uncertainty in the forecasts, you show it by lowering the 'dots' when your forecasts suggest otherwise, and sounding dovish.