US financial conditions and commodity prices ahead of the historical FOMC tomorrow

Posted on December 15th, 2015

Main takeaways:

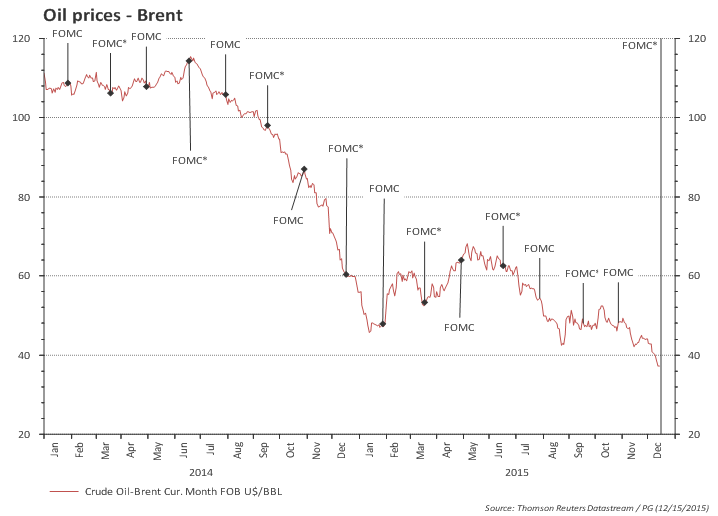

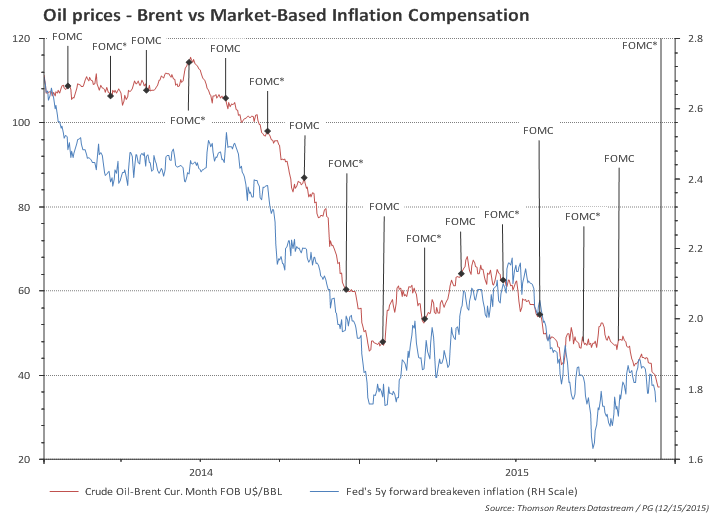

- Commodities (including oil) breaking new lows.

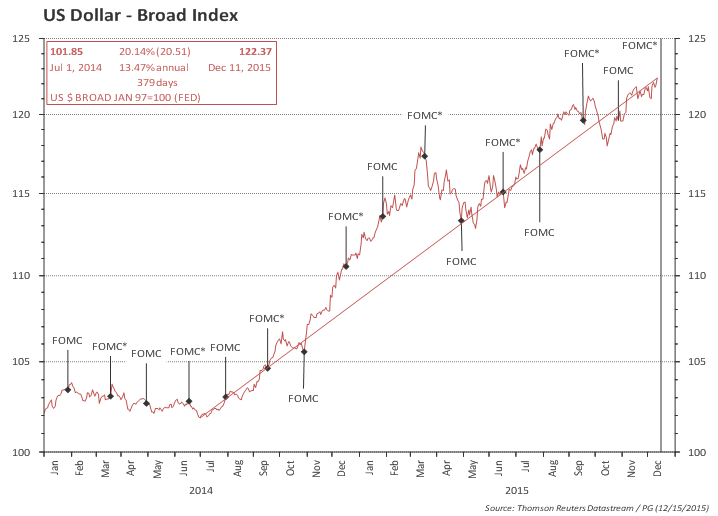

- Strong USD.

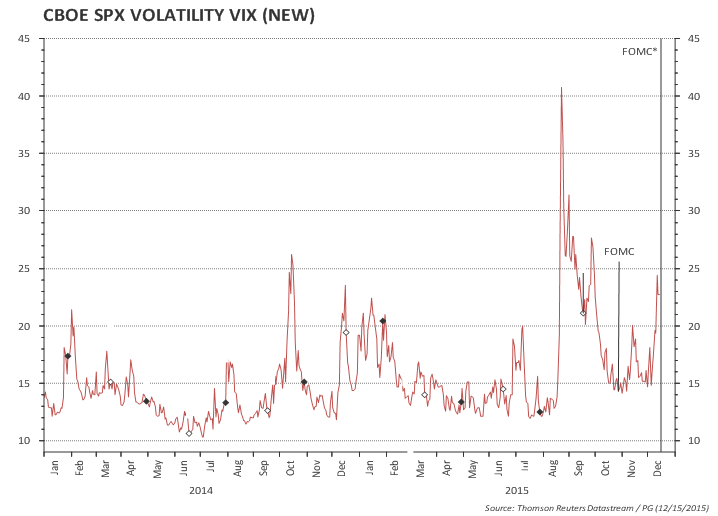

- Equities off the highs with increasing vol.

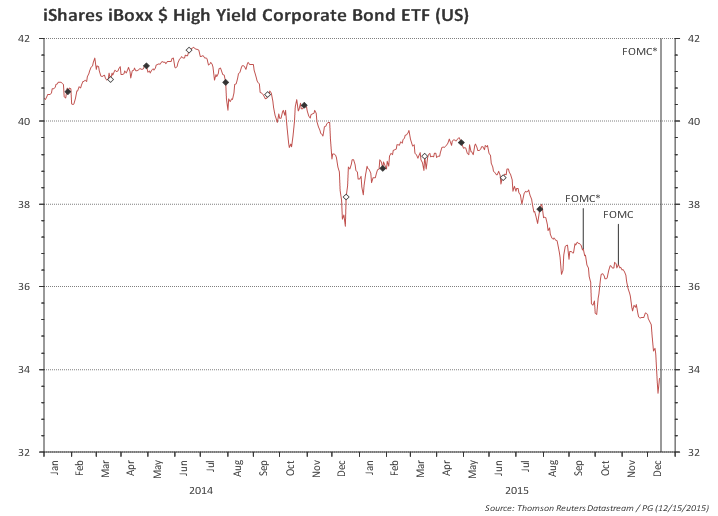

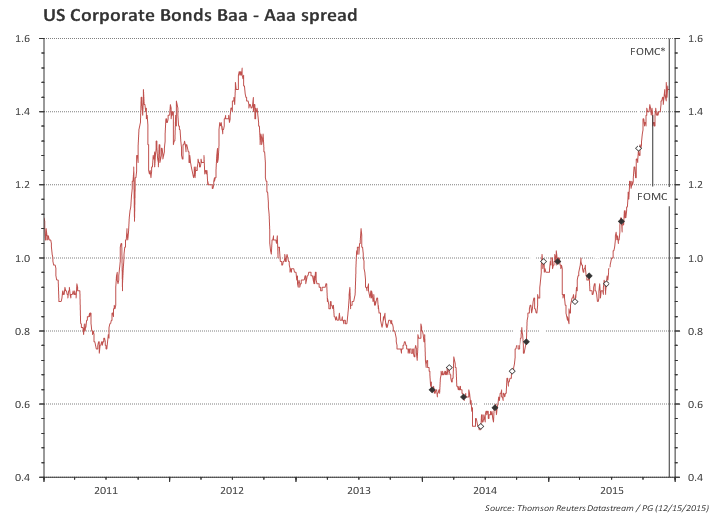

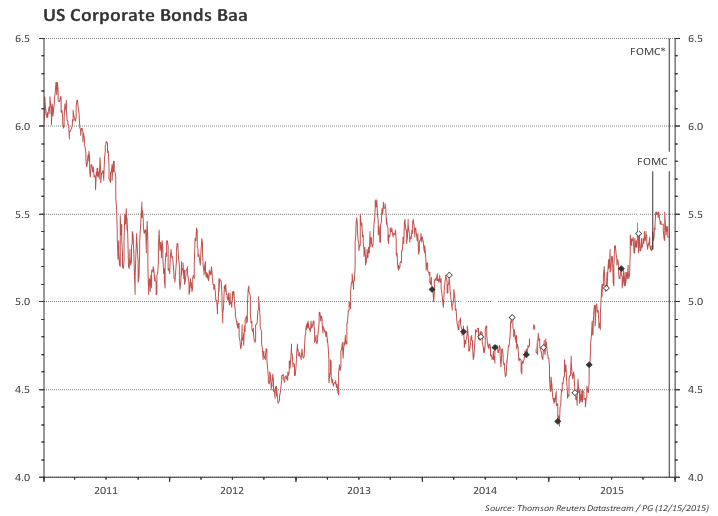

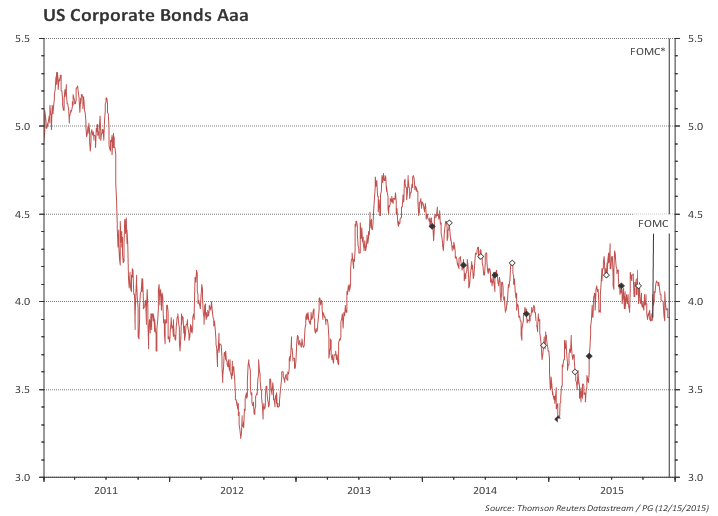

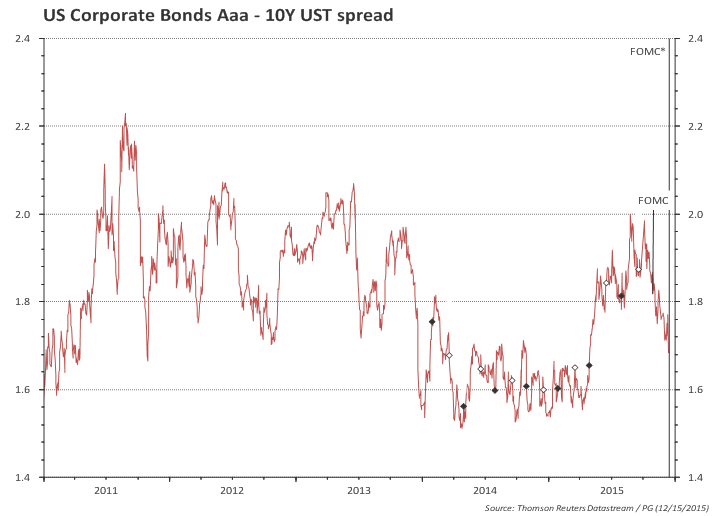

- Baa - Aaa spreads widening. High yield mkt close to panic.

- But overall financial conditions are off the highs observed earlier in the year.

Charts

US trade-weighted dollar is higher than earlier in the year, when Fed warned about its negative consequences to the economy.

Oil prices are also at the lows.

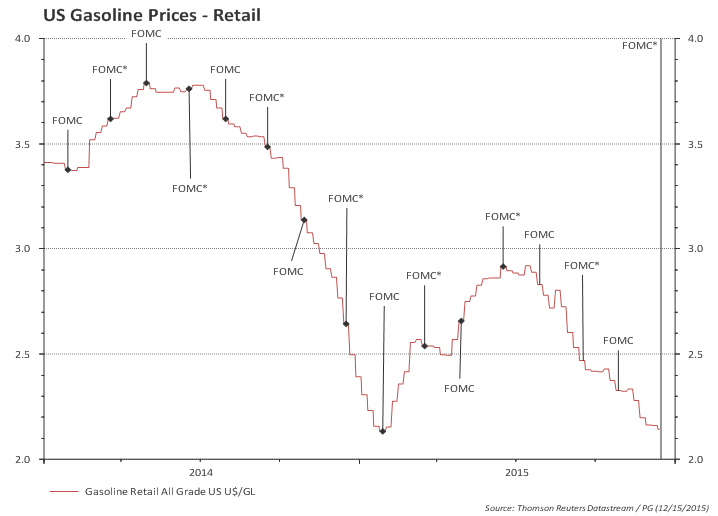

Retail gasoline prices are close to the lows.

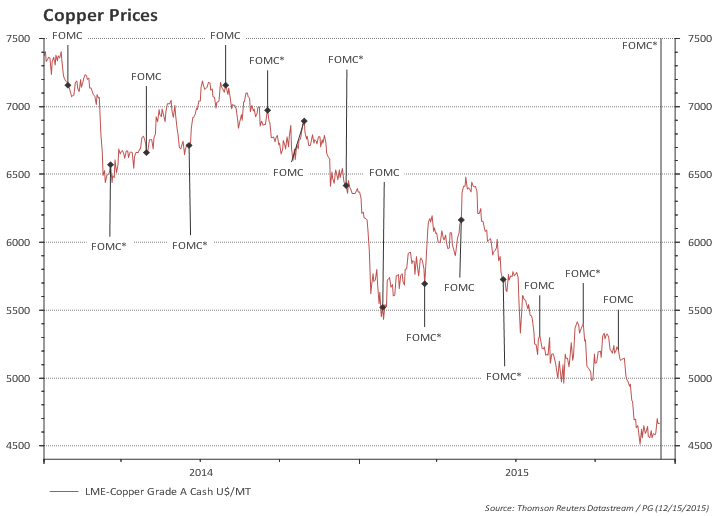

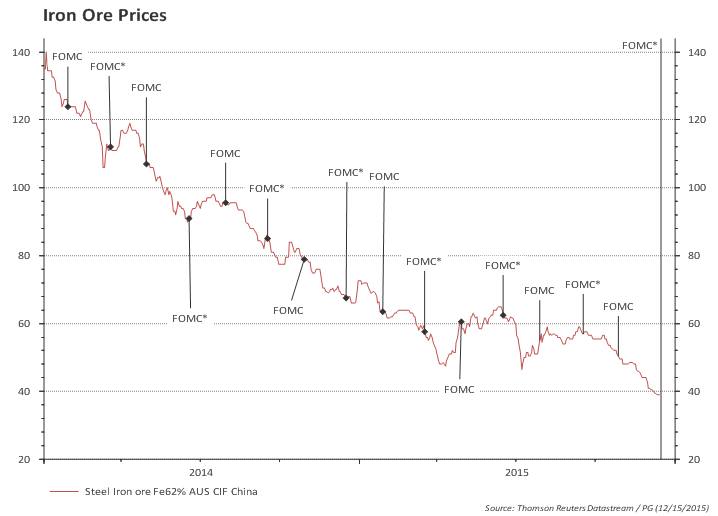

Commodity prices also at the lows.

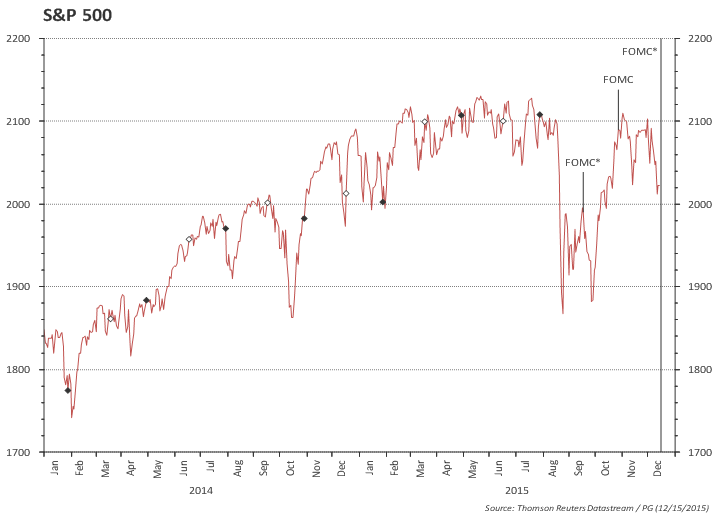

US equities recovered part of its Aug/Sep losses, but face renewed uncertainty.

Equity vol is high again.

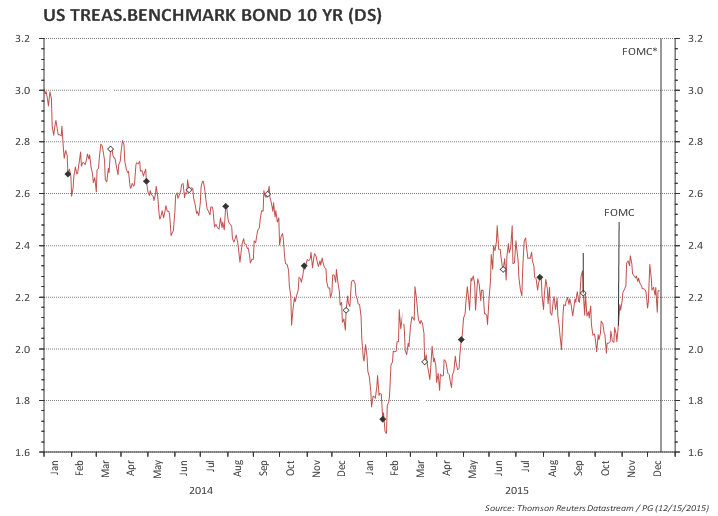

US 10y Treasuries

Baa spreads widened

Market-based inflation compensation sharply down, but this could just be oil prices

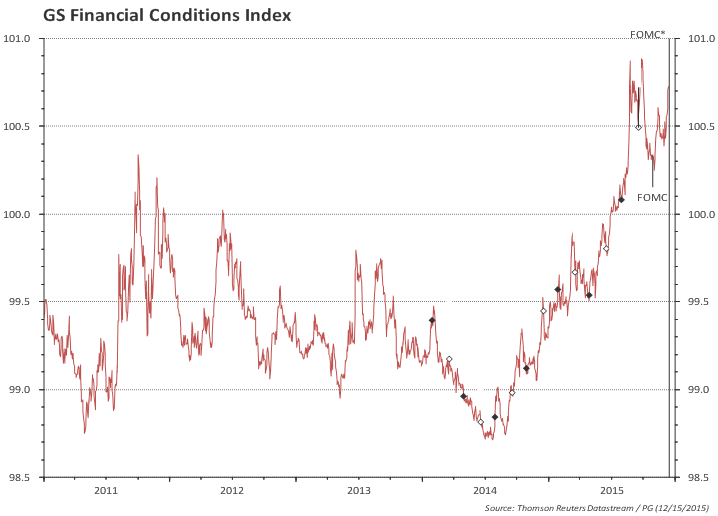

Financial conditions, as measured by GS, are tighter than in the last few years.

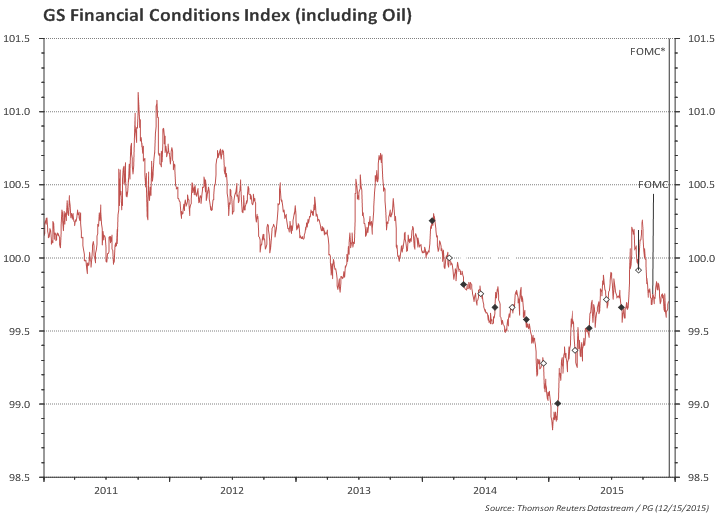

...but broadening the definition to include oil prices show a more benign picture

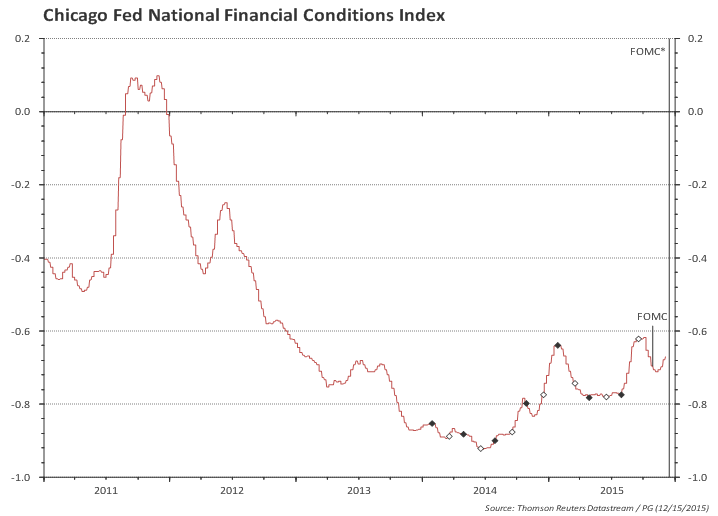

Financial conditions, as measured by the Chicago Fed, also show a tightening, but overall levels remain in the accommodative range

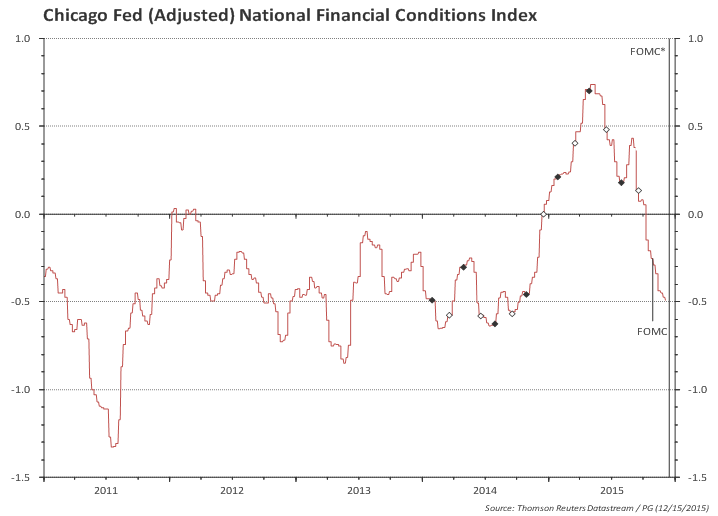

Adjusting for the business cycle, Chicago Fed index suggest that financial conditions moved to tight earlier in 2015 and are now back to easy.

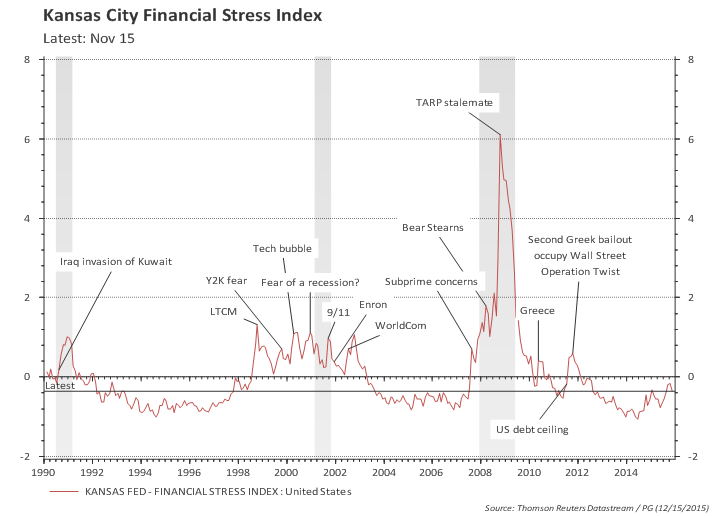

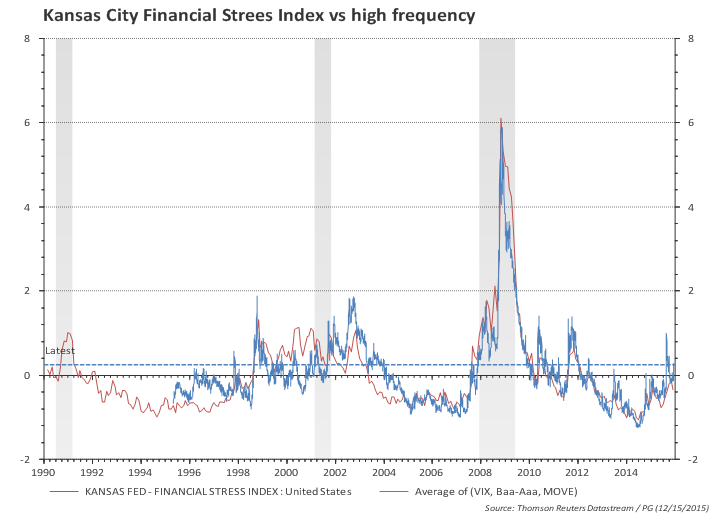

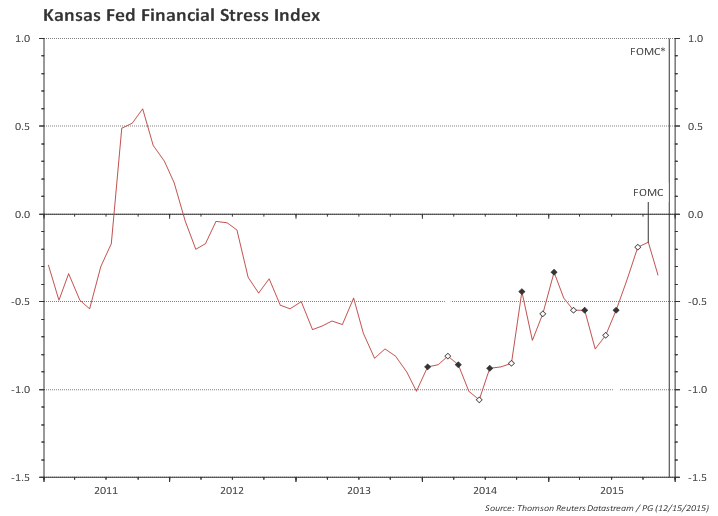

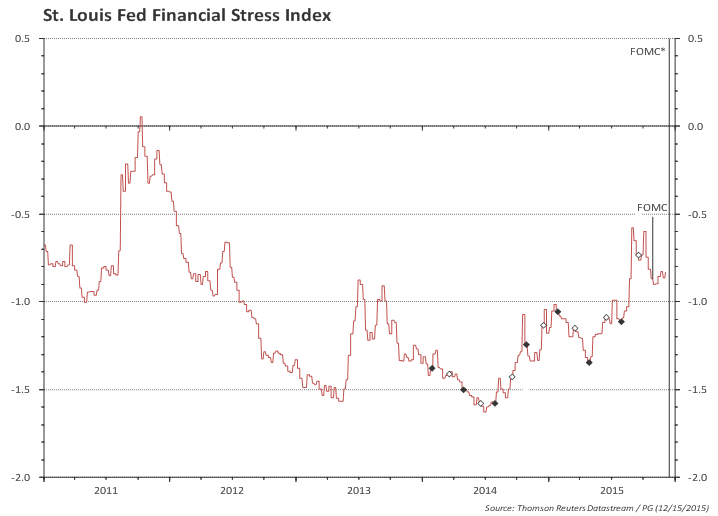

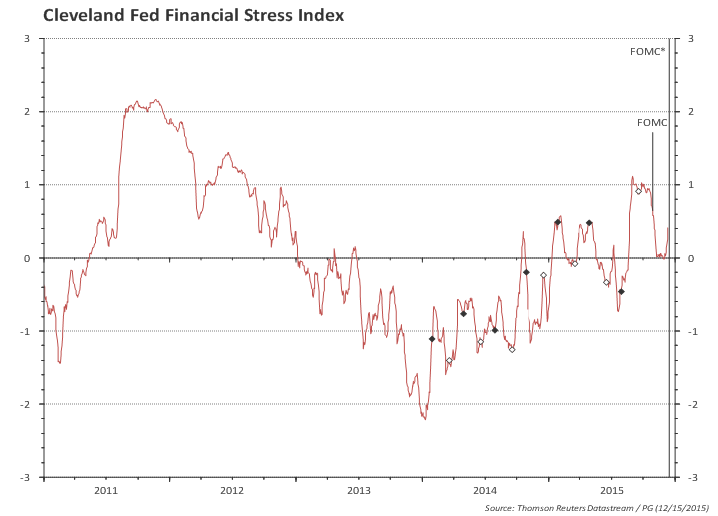

Below, some additional financial conditions and financial stress indices

Longer history of financial conditions and the relevant episodes.