Main takeaways:

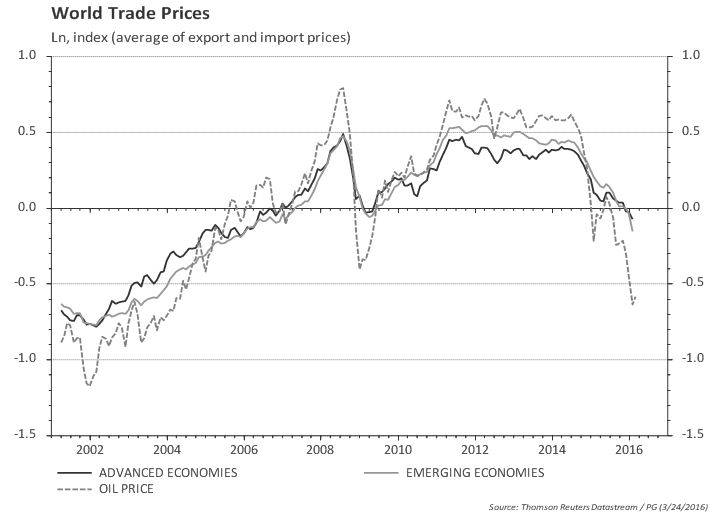

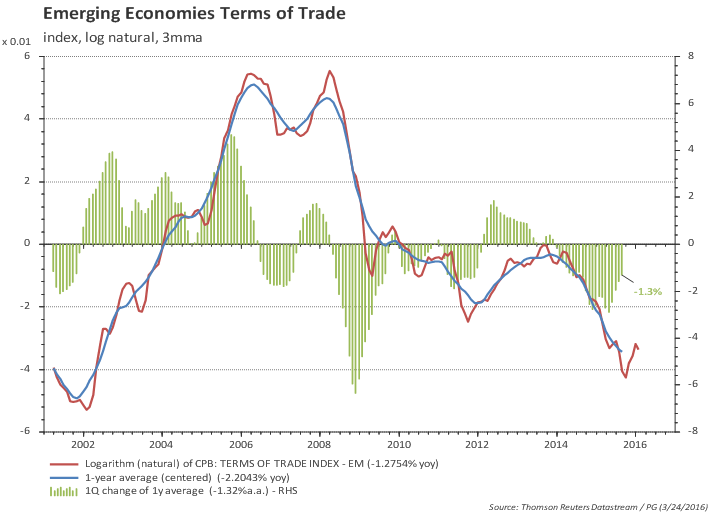

* Global risks the main reason behind FOMC's dovish stance (China, strong dollar).

* I think the odds are for an improving global backdrop in the coming months.

* Global (and US) manufacturing showing some tentative signs of improvement...

* ...but consumption softens in the US. It is likely temporary, but will keep Fed on hold.

* Improving labor force participation and lack of wage growth helps Fed's narrative (but recall ULC is increasing at the same pace as 2004!).

* Yellen has questioned the recent firming of core inflation. She was right once (recall "inflation is noisy" comment in 2014). But not likely to be right this time - a myriad of inflation indicators suggest the pickup in core inflation may be sticky.

* FOMC focus on global risks, asymmetry, and inflation expectations opens room for inflation swaps / TIPS to move higher.

Conclusions:

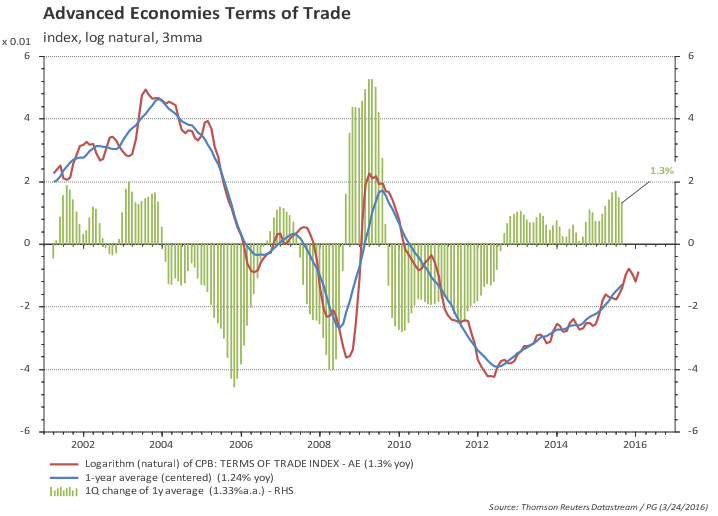

* As anticipated in our last outlook report the Fed decided to pause to watch: impact of tightening financial conditions, dollar and oil/commodity prices, drop in inflation expectations, path of actual inflation, ISM and manufacturing data, credit data, inventory adjustment.

* But the Fed also opted to emphasize risks to the global economy and the asymmetric risks facing the normalization of policy rates.

* Fed stopped short of supporting a period of inflation overshoot to offset the below target prints.

* Soft-patch in consumption in 1Q (despite incipient manufacturing rebound) keeps pushing forward the next rate increase.

* Risks abound, but my guess is that the economy will remain in the current path, global worries would not escalate and, by mid 2016, the Fed would be ready to signal rate hikes would resume. Two hikes in the second half of 2016 continues to be a reasonable base case (July or Sept for the next one).

Trading views: inflation swaps embedds a lot of downside risks

* Intermediary inflation swaps (5-year swap, 2 years forward) appear too low.

* Inflation in the last five years was 1.4%/year, even after the large drop in energy prices !!

* If oil prices stabilize, inflation would increase to 2.0%-2.5%.

* Recall the Fed story of asymmetric risks favor a pickup in inflation.

* But wasn't this pick-up in inflation the story of 2015? Yes, but China and oil changed the picture. Would it happen again?

* Recall that, a year later, the economy is even closer to NAIRU. Is the Phillips curve really dead?