Main takeaways:

- Forecast for 2015 are likely to be bullish:

- GDP growth might be revised upwards by 0.3pp

- Unemployment rate likely to be revised down by 0.2pp

- Core PCE likely to be revised upwards a bit or remain unchanged

- Headline PCE likely to be unchanged

- Forecasts for 2016, 2017 and the new 2018 forecasts are harder to guess. A gloomy view of world growth and further dollar strengthening could lead to lower growth and inflation in 2016 -- thus supporting lower dots.

- Even if growth in 2016 and 2017 are not revised down, dots could move down due to 'headwinds'.

- Recent talks and concern with low productivity could lead to a bit lower potential growth and lower longer run terminal interest rate

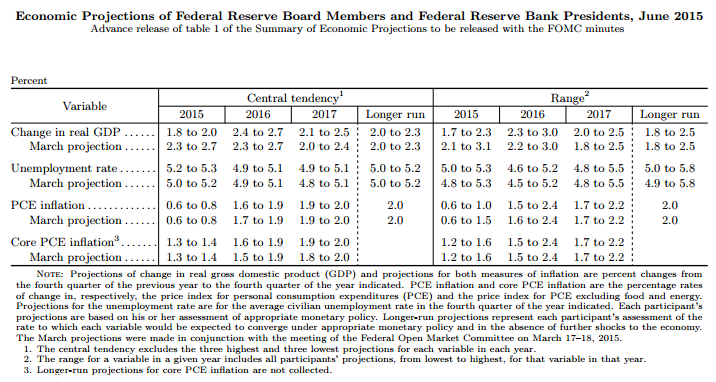

- Fed will officially report the median forecasts (including median 'dots'). June median 'dots' were 0.625 for 2015 and 1.625 for 2016.

The table below shows the Fed forecasts as of June.

One interesting question is how the forecasts could change at the upcoming meeting.

Let's take a look:

GDP Growth:

By the time of June's forecast, the Fed knew first quarter growth had been -0.7% and market consensus for 2Q was around 2.5%. The 2015 year-end forecast, then, had an implied quarterly growth of in the 2.7% to 3.2% range for the second half of the year.

Since then, we learned that first quarter growth was revised up from -0.7% to +0.6% and that 2Q printed 3.7%. Keeping the same expected growth rate for the second half of 2015 would imply a large upward GDP growth revision to 2.4% to 2.7%(!) range, roughly back to where the forecasts were in March.

Such upward revision is not likely due to slower global growth, another hit to oil investment, stronger dollar, among others. However, even if growth in the second half is downgraded to 2% to 2.6% range, GDP growth forecast for 2015 is likely to be revised up by 0.3pp.

Unemployment:

By the time of June's forecast, the Fed knew unemployment rate had reached 5.5% in May. Its 2015 forecast implied an average drop of 0.3 to 0.5 pp (annualized) until year-end. Unemployment rate dropped by 1.6pp (annualized) in the 3-month period (Jun-Aug) and the latest reading (5.1%) is already below the central tendency range of 5.2% to 5.3%.

The odds are unemployment rate forecast will be cut back to March's forecast or even a bit lower.

Headline Inflation:

By the time of June's forecast, the Fed knew PCE inflation had printed 0.1% yoy in April and its 2015 forecasts implied inflation running in the 1.1% to 1.4% range until year-end. PCE inflation was 2.5% in the following three months (May-Jul).

Keeping the PCE inflation forecast would imply an average inflation in the 0.2% to 0.7% range from August to December. The most recent drop in oil prices have the potential to keep headline inflation at the low end of this range -- therefore its hard to guess whether headline inflation forecasts will be changed.

Core Inflation:

By the time of June's forecasts, the Fed knew Core PCE inflation had printed 1.2% yoy in April and its 2015 forecasts implied core inflation running in the 1.3% to 1.5% range until year-end. Core PCE inflation was 1.4% in the May-July period, in line with Fed's forecast. However, other measures of core inflation (trimmed mean PCE) and the reduction of unemployment rate suggest a higher pace of inflation in the coming months. Barring a further decline in oil prices, it seems 1.4% could be the floor in the coming months -- therefore the odds are core PCE will be revised a bit upwards.